Xero vs. QuickBooks: Choosing the Best Accounting Software for Your Business

Xero and QuickBooks are two leading accounting software solutions designed to streamline financial management for small businesses. Founded in 2006, Xero is renowned for its user-friendly interface and robust cloud-based platform. On the other hand, QuickBooks, developed by Intuit, has been a staple in the accounting industry since its inception in 1983, offering a wide range of features tailored to various business needs.

Xero and QuickBooks are two leading accounting software solutions designed to streamline financial management for small businesses. Founded in 2006, Xero is renowned for its user-friendly interface and robust cloud-based platform. On the other hand, QuickBooks, developed by Intuit, has been a staple in the accounting industry since its inception in 1983, offering a wide range of features tailored to various business needs.

Selecting the appropriate accounting software is crucial for the success and growth of small businesses. These platforms simplify everyday financial tasks, provide insights into business performance, facilitate compliance with tax regulations, and aid decision-making processes. Moreover, choosing the right software can enhance efficiency, reduce errors, and save valuable time and resources.

This blog is a comprehensive guide, meticulously comparing Xero and QuickBooks across critical features, pricing structures, and functionalities. By diving deep into the strengths of each platform, we'll equip you with the knowledge to make an informed decision tailored to your specific business needs.

Contents

Xero vs. QuickBooks: Choosing the Right Accounting Software for Your Business in 2024

Understanding Your User

Tailored Features for Evolving Needs

Pricing Showdown: Xero vs. QuickBooks - Finding the Financial Fit

Xero: Unveiling the Subscription Tiers

Demystifying QuickBooks Online Pricing

Navigating the Cost Maze: Xero vs. QuickBooks

Scalability & Integrations: How Xero & QuickBooks Empower Your Growing Business

Pros and Cons: A Breakdown

Scalability and Integrations: Growing with Your Business

Scalability: Adapting to Your Growth Journey

Alternative Accounting Software Options: Navigate Beyond the Giants

Unveiling the World of Alternative Accounting Software

Wrap Up

FAQs

Xero vs. QuickBooks: Choosing the Right Accounting Software for Your Business in 2024

Selecting the ideal accounting software is crucial for any business. It empowers informed financial decision-making and streamlined financial management. Two industry leaders, Xero and QuickBooks, stand out with robust features catering to various business needs. But which one is right for you? This comprehensive analysis delves into the core functionalities of Xero and QuickBooks, guiding you towards the platform that best aligns with your specific requirements.

Understanding Your User

QuickBooks: Designed with user-friendliness in mind, QuickBooks is perfect for small business owners with limited accounting expertise. Its intuitive interface and clear navigation make it easy to grasp financial data, even for those unfamiliar with accounting intricacies.

Xero: Xero prioritises advanced features and customisation options, making it a favourite amongst accountants and bookkeepers. While the initial interface might appear more complex, it empowers professionals with a comprehensive toolkit to handle even the most intricate financial tasks.

Tailored Features for Evolving Needs

Inventory Management

QuickBooks: Streamlines stock control and tracking with built-in inventory management features. Efficiently manage product inventory, monitor stock levels, and generate insightful reports to optimise your operations.

Xero: While offering inventory management, there are other focuses besides this. Businesses with extensive inventory needs may require integrations with third-party solutions for robust tracking capabilities.

Project Profitability Tracking

Xero: Xero excels in project management by providing advanced tools for tracking project expenses and estimating real-time profits. With Xero, you can quickly gain insights into project costs, analyse profitability, and make informed decisions to enhance project outcomes. It's essential to note that while these features are powerful, it's important to check for any additional costs associated with using them, as these may vary depending on your region.

QuickBooks: Provides basic project tracking features, offering insights into project expenses and revenue. However, the functionalities may be limited compared to Xero's comprehensive suite.

Embracing the Global Marketplace

Xero: With robust multi-currency support, Xero empowers businesses to navigate international expansion confidently. Conducted transactions in multiple currencies and managed foreign exchange fluctuations effectively, fostering seamless global trade.

QuickBooks: While offering some international functionality, its multi-currency support might need to be improved. Businesses with a global presence may find Xero's comprehensive multicurrency capabilities a significant advantage.

Security and Support: A Top Priority

Both Xero and QuickBooks prioritise security, implementing industry-standard encryption techniques and stringent data protection measures to safeguard your sensitive financial information. Additionally, they provide responsive customer support via email, phone, and live chat to promptly address your queries and concerns.

The optimal choice between Xero and QuickBooks hinges on your business needs and goals.

Ideal For

QuickBooks: Small businesses with basic accounting requirements seek a user-friendly platform.

Xero: Businesses with complex financial operations, global aspirations, or those requiring advanced project management functionalities.

For a deeper dive into comparing features, please refer to the table below.

By carefully evaluating the features and functionalities of Xero and QuickBooks in the context of your unique business objectives, you can make an informed decision that empowers you to streamline your financial management processes and propel your business towards success.

Pricing Showdown: Xero vs. QuickBooks - Finding the Financial Fit

Unveiling your business's financial health requires a robust accounting software solution. But with a plethora of options, choosing the right one can be overwhelming. The critical factor often refers to finding the perfect equilibrium between affordability and functionality. Here, we delve into the pricing structures of Xero and QuickBooks, equipping you to make an informed decision tailored to your specific business needs.

Xero: Unveiling the Subscription Tiers

Xero caters to businesses of all sizes with its three meticulously crafted subscription plans:

Early (Starting at $15/month)

This budget-friendly plan is a haven for freelancers and sole proprietors. It prioritises core accounting functionalities like:

Invoicing: Effortlessly create and send professional invoices to streamline your billing process.

Bank Reconciliation: Ensure your financial records stay aligned by seamlessly reconciling your bank statements.

Expense Tracking: Gain a clear view of your business spending with intuitive expense tracking tools.

Note: The true star of the ‘Early’ plan is unlimited users. This empowers collaborative teams to access and manage financial data simultaneously, fostering transparency and efficiency.

Growing (Starting at $40/month)

As your business expands, so do your accounting needs. The ‘Growing’ plan builds upon the ‘Early’ plan's foundation by introducing:

Inventory Management: Take control of your stock with features to track inventory levels, manage purchase orders, and optimise stock flow.

Project Tracking: Monitor the financial performance of individual projects, ensuring profitability and informed decision-making.

Multi-Currency Support: Embrace the global marketplace by managing finances in multiple currencies, simplifying international transactions.

This plan caters perfectly to growing businesses with evolving accounting requirements.

Established (Starting at $70/month)

For well-established businesses, the ‘Established’ plan offers a comprehensive suite of advanced features:

Payroll Integrations: Streamline payroll processing with third-party payroll services (additional costs apply).

Advanced Reporting: Generate in-depth financial reports to gain valuable insights into your business performance and identify areas for optimisation.

Workflows: Automate repetitive tasks and create custom workflows to enhance efficiency and reduce manual errors.

This plan empowers businesses with data-driven decision-making and simplifies intricate financial processes, making it an ideal choice for those needing a solid accounting solution.

For detailed pricing information tailored to specific regions, please refer to the links provided below:

Australia: https://www.xero.com/au/pricing-plans/

United States: https://www.xero.com/us/pricing-plans/

United Kingdom: https://www.xero.com/uk/pricing-plans/

New Zealand: https://www.xero.com/nz/pricing-plans/

Demystifying QuickBooks Online Pricing

QuickBooks Online mirrors Xero's tiered pricing structure, offering plans that cater to various business needs:

Simple Start (Starting at $30/month)

This entry-level plan is designed for freelancers and startups, offering the essentials to get you started:

Invoicing: Create and send invoices to manage your billing efficiently.

Expense Tracking: Keep a close eye on your business spending with built-in expense tracking tools.

Bill Pay: Simplify bill payments directly from within the software (limited features in the Simple Start plan).

Note: However, a crucial caveat exists: Simple Start only allows one user, which can be restrictive for collaborative teams.

Essentials (Starting at $70/month)

As your business scales, the ‘Essentials’ plan provides the features needed for growth:

Inventory Management: Manage your stock effectively with features similar to those in Xero's Growing plan.

Project Profitability Tracking: Gain insights into the profitability of individual projects, allowing for strategic resource allocation.

Time Tracking: Track employee work hours for accurate payroll processing and project costing.

Note: Essentials allows up to five users, facilitating collaboration within small teams.

Plus (Starting at $100/month)

For established businesses, the Plus plan unlocks advanced functionalities:

Bill Pay with Auto-Pay: Automate bill payments for recurring expenses, saving time and ensuring timely payments.

Advanced Inventory Management: With features beyond those offered in the Essentials plan, you can gain greater control over your stock.

Multiple Users (Up to 25): This option enables collaboration for larger teams, with access for up to 25 users.

This plan caters to established businesses that require advanced features and multi-user access.

Advanced (Starting at $200/month)

This top-tier plan is geared towards large enterprises, offering:

In-Depth Reporting: Generate highly customisable reports for comprehensive financial analysis.

Budgeting: Create detailed budgets to forecast future financial performance and ensure economic sustainability.

Workflow Automation: Automate complex workflows to streamline operations and minimise human error.

For a comprehensive understanding of the pricing details for different QuickBooks plans across various regions, you can refer to the links provided below:

Australia: https://quickbooks.intuit.com/au/pricing/

United States: https://quickbooks.intuit.com/pricing/#

United Kingdom: https://quickbooks.intuit.com/uk/pricing/

Navigating the Cost Maze: Xero vs. QuickBooks

While a direct price comparison reveals Xero's Early and Growing plans might be slightly cheaper, the actual cost analysis hinges on your business needs. Here's a breakdown to help you make an informed decision:

Freelancers and Startups

Xero: The Early plan offers a budget-friendly option with the significant advantage of unlimited users, perfect for collaborating with contractors or virtual assistants.

QuickBooks: The Simple Start plan might seem tempting due to its lower starting price, but the single-user limitation can hinder collaboration.

Growing Businesses

Xero: The Growing plan offers competitive features at a price point similar to QuickBooks' Essentials plan. Consider if unlimited users in Xero outweigh the additional features (like project profitability tracking) offered by QuickBooks.

QuickBooks: The Essentials plan provides a well-rounded feature set for growing businesses. However, the five-user limit might become restrictive as your team expands.

Established Businesses

Xero: The Established plan boasts a slightly lower price tag than QuickBooks' Plus plan. However, the Plus plan offers more users (up to 25) and potentially valuable features like automated bill pay.

The Payroll Factor

It's crucial to remember that neither Xero nor QuickBooks include payroll processing in their base plans. Both integrate with third-party payroll services, incurring additional costs—factor in these fees when making your final decision.

Making the Perfect Choice

The ideal accounting software hinges on a synergy between affordability and functionality. Here are some additional considerations:

Ease of Use: Evaluate the user interface of both platforms. Xero is known for its intuitive design, while QuickBooks might require a steeper learning curve.

Scalability: Consider your future growth plans. If you anticipate rapid expansion, a platform with scalable features might be more suitable.

Integrations: Identify any third-party applications your business utilises. Ensure compatibility with your chosen accounting software.

By carefully analysing the pricing structures, features, and additional considerations, you'll be well-equipped to select the accounting software that perfectly aligns with your budget and propels your business towards financial success.

Scalability & Integrations: How Xero & QuickBooks Empower Your Growing Business

Choosing the right accounting software is crucial for any business, but the decision can be overwhelming, with industry giants like Xero and QuickBooks dominating the market. This in-depth analysis will equip you with the knowledge to make an informed choice based on your needs.

Pros and Cons: A Breakdown

Xero: Your Cloud-Based Accounting Ally

Pros

Cost-effective Champion: Xero shines with its budget-friendly pricing, especially for businesses with multiple users. The unlimited user policy on all plans makes it a game-changer for growing teams, constantly eliminating the need to upgrade for additional user access.

Location Independence: Xero thrives in the cloud, allowing you to access your financial data anywhere with an internet connection. This empowers remote teams to collaborate seamlessly and ensures you have real-time financial insights at your fingertips.

Intuitive Interface: Xero's user-friendly interface is a breath of fresh air for those without an accounting background. The clean layout and straightforward navigation make it easy to learn and use, even for beginners.

Streamlined Contact Management: Xero offers robust contact management features beyond basic accounting. Manage customer and vendor information efficiently within the platform, centralising communication and organising your data.

Project Profitability Powerhouse: Xero's project tracking capabilities allow you to gain a deeper understanding of your business. Track income and expenses by project, allowing you to identify profitable ventures and optimise resource allocation for better decision-making.

Cons

Invoice Limit Hurdle: Be mindful of invoice volume when choosing a Xero plan. The lower-tier plans restrict the number of invoices you can send per month. If you have a high invoicing volume, consider upgrading to a higher tier to avoid limitations.

Payroll Limitations: While Xero offers basic payroll features, complex payroll needs require integration with a third-party service, adding an extra layer of cost and complexity.

QuickBooks: The Established Accounting Powerhouse

Pros

Industry Leader for a Reason: QuickBooks boasts a well-established reputation for a reason. It's a trusted accounting software with a vast user base, offering reliable features and a wealth of knowledge resources available online and through their support channels.

Feature-Rich Powerhouse: QuickBooks is packed with features to streamline your accounting processes. It caters to many business needs, from robust inventory management to budgeting tools and cash flow forecasting.

Customisation Champion: Tailor QuickBooks with highly customisable reports and workflows that fit your business needs. This level of granular control empowers you to leverage the software to its full potential.

Integration Ecosystem: Expand QuickBooks' functionality seamlessly with its vast library of third-party integrations. From CRM platforms to marketing tools, connect the applications you rely on to create a unified business ecosystem.

Desktop Option for Offline Access: For those who prefer the comfort of offline access, QuickBooks offers a desktop application in addition to its cloud-based version. This flexibility caters to businesses with varying preferences.

Cons

Cost Consideration: QuickBooks plans are slightly more expensive than Xero, especially for higher-tier plans with advanced features. Carefully evaluate your needs and weigh the cost-benefit analysis before committing.

User Limitations: Similar to Xero's invoice limits, QuickBooks plans to restrict the number of concurrent users accessing the software. This can be a hurdle for larger teams, requiring them to upgrade to a more expensive plan to accommodate everyone.

Scalability and Integrations: Growing with Your Business

Scalability: Adapting to Your Growth Journey

Xero: Xero's cloud-based nature makes it a champion of scalability. Its tiered pricing plans allow businesses to upgrade as their needs evolve seamlessly. Adding more users and functionalities becomes a breeze, ensuring your accounting software keeps pace with your growth.

QuickBooks: While QuickBooks offers scalability through tiered plans, some advanced features may only be available in the highest tiers. Additionally, the user limitations on some plans can restrict scalability for larger teams. Carefully consider your future growth projections when choosing a QuickBooks plan.

Additional Features and Integrations: Power Up Your Processes

Seamless Transactions and Effortless Reconciliation

Both Xero and QuickBooks excel in core accounting functionalities. However, for businesses that utilise multiple payment gateways and e-commerce platforms, managing transactions and ensuring accurate reconciliation can take time and effort. This is where services like SaasAnt Transactions and PayTraQer come in.

SaasAnt Transactions: This powerful application seamlessly integrates with Xero, allowing you to import, export, and even delete transactions directly from Excel, CSV, and PDF files. This eliminates manual data entry and streamlines the reconciliation process, saving valuable time and minimising errors.

PayTraQer: If your business relies heavily on online payments and e-commerce sales, PayTraQer can be a game-changer. This application bridges Xero (or QuickBooks), popular payment processors like Stripe, PayPal, and Square, and marketplaces like Amazon and eBay. PayTraQer synchronises sales data, fees, refunds, taxes, and expenses, ensuring your accounting software reflects your real-time financial picture.

Popular Integrations (Beyond SaasAnt and PayTraQer)

In addition to SaasAnt Transactions and PayTraQer, both Xero and QuickBooks offer a vast library of third-party integrations to enhance functionality. Here are some famous examples:

Xero

Payment Processing: Stripe, PayPal

Spreadsheets: Google Sheets

Ecommerce: Shopify

QuickBooks

Bill.com: Streamline accounts payable processes.

Square: Integrate seamlessly with Square point-of-sale systems.

Salesforce: Enhance customer relationship management.

Alternative Accounting Software Options: Navigate Beyond the Giants

Household names like Xero and QuickBooks may dominate the market, but there are many alternative accounting software programs to suit all sorts of business needs and budgets. This section is here to guide you through these alternatives, help you compare them to the big players, and potentially find the perfect match for your company.

Unveiling the World of Alternative Accounting Software

The realm of accounting software goes far beyond the traditional heavyweights. Alternative programs present captivating features and functionalities, often specialising in specific areas to enhance your financial management experience. Here's a breakdown of some key categories:

Cloud-based Solutions: Embrace the flexibility and accessibility of the cloud. These programs eliminate software installation hassles and enable real-time collaboration for geographically dispersed teams. They are perfect for businesses that value mobility and remote work capabilities.

Freelancer and Startup Powerhouses: Streamlined interfaces and budget-friendly pricing make these alternatives ideal for solopreneurs and budding businesses. They often prioritise user-friendliness and core features like invoicing and expense tracking, allowing you to focus on growing your venture.

Advanced Functionality Powerhouses: They lack essential features. Some alternative programs cater to established businesses with complex needs. Project management, inventory control, and robust reporting capabilities empower you to gain deeper insights and streamline operations.

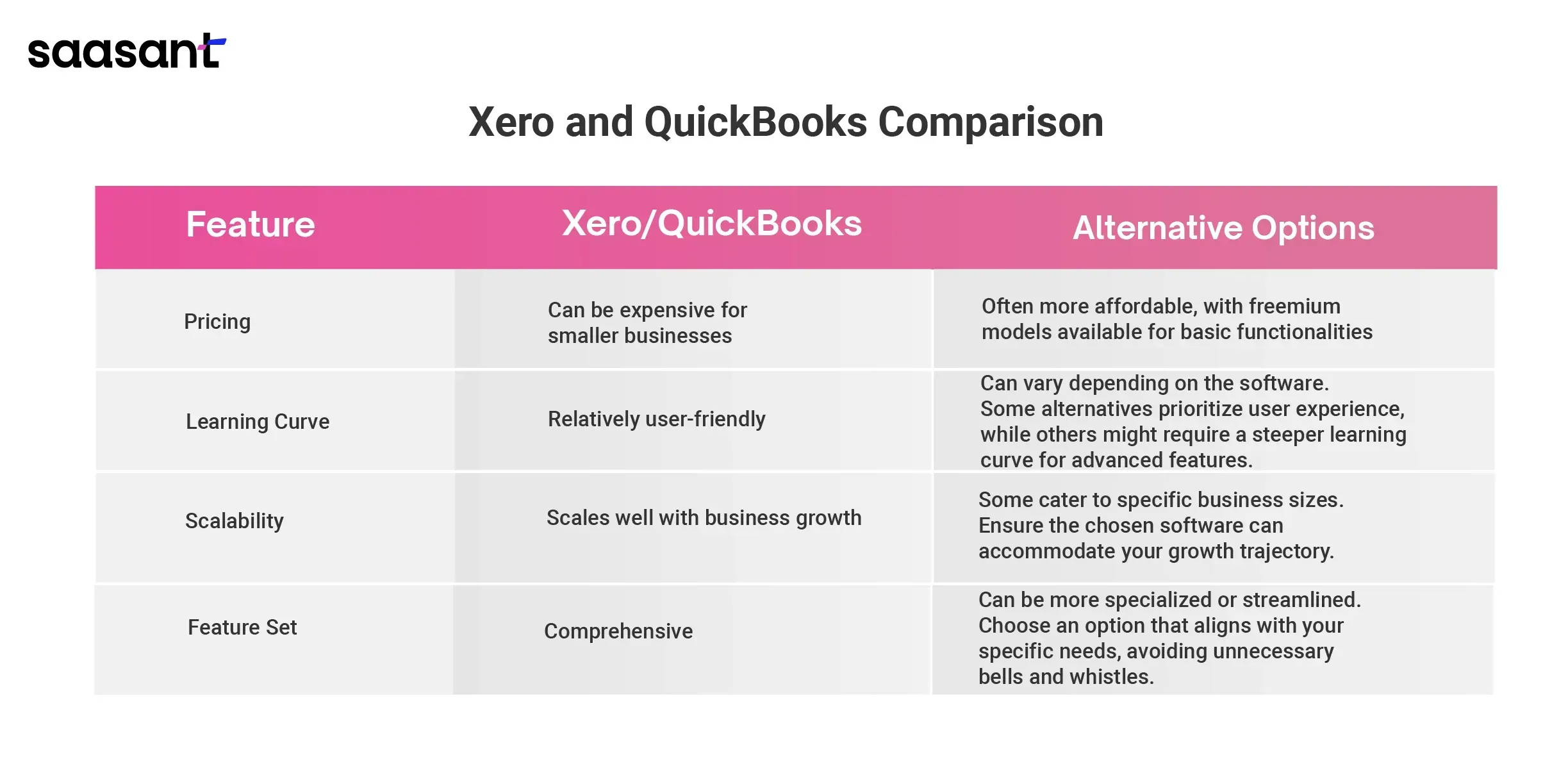

Xero and QuickBooks: A Benchmark for Comparison

While Xero and QuickBooks are established leaders, alternative software can offer a compelling value proposition. Let's delve into a side-by-side comparison to understand the key differentiators:

Unveiling the Powerhouses: FreshBooks and Wave

FreshBooks: Streamlined Accounting for Freelancers and Service-based Businesses

FreshBooks is a cloud-based accounting software that has carved a niche in the freelancer and service-based business landscape. It boasts the following strengths:

User-friendly Interface: Thanks to its intuitive design, accounting novices can easily navigate FreshBooks.

Robust Invoicing Features: Create professional invoices, automate recurring billing, and track payments efficiently.

Seamless Integrations: Integrate FreshBooks with popular payment gateways like Stripe and PayPal for effortless payment processing.

Wave: Unleash Free Accounting for Budget-Conscious Businesses

Wave is a compelling option for businesses seeking to manage their finances without breaking the bank. It offers a freemium model, providing core functionalities for free:

Basic Accounting Functionalities: Create invoices, scan receipts, and track expenses effortlessly, even with the free plan.

Paid Plans for Advanced Features: As your business grows, upgrade your plan to unlock bank reconciliation, custom reports, and advanced features.

Cost-Effective Solution: Wave caters to budget-conscious businesses, offering a free plan and affordable paid options.

Industry-Specific Accounting Needs: Finding Your Perfect Fit

While some alternative software caters to a broad audience, others specialise in meeting the unique needs of specific industries. Here are some examples:

Construction: Look for features like job costing, project management tools, and lien tracking to streamline your construction operations.

E-commerce: Seamless integration with online marketplaces, inventory management functionalities, and real-time sales tracking are crucial for e-commerce businesses.

Non-profits: Grant management, donor tracking, and specialised reporting features can be invaluable for non-profit organisations.

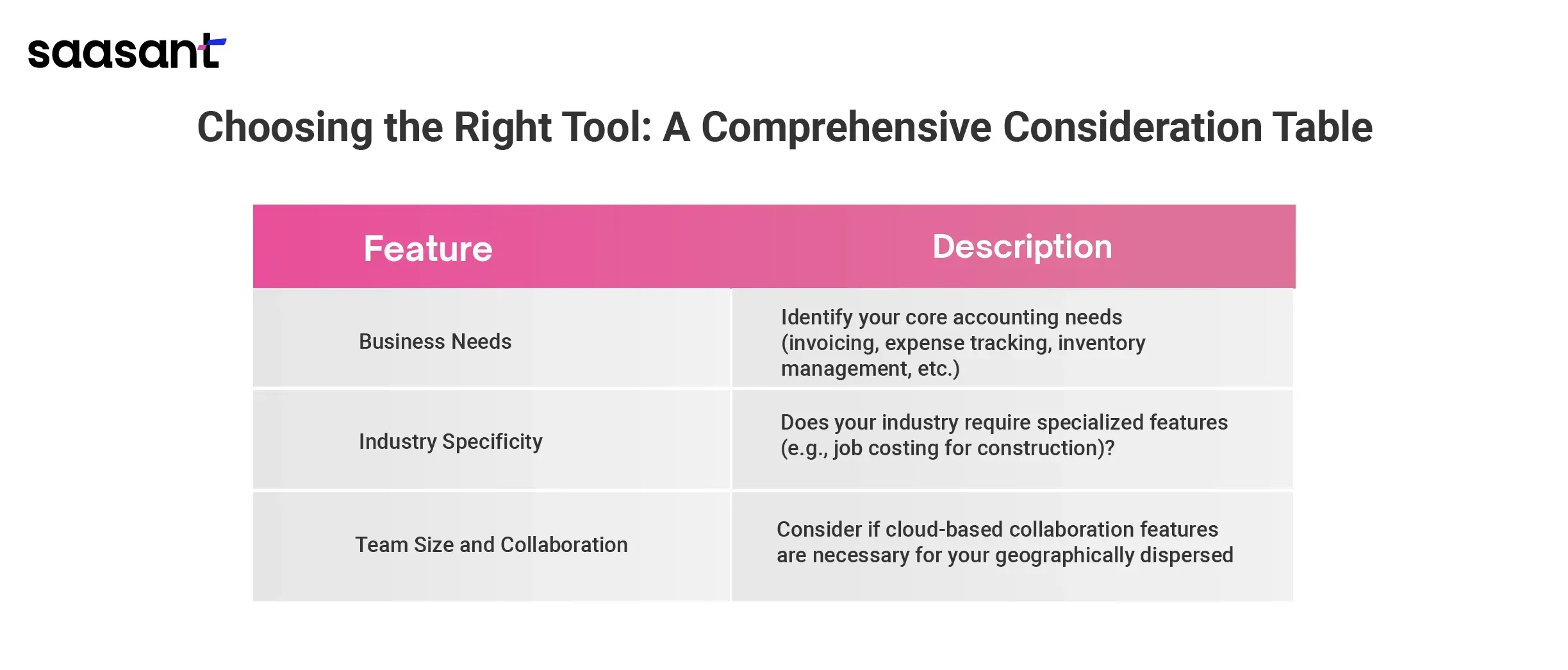

Choosing the Right Tool: A Comprehensive Consideration Table

To empower your decision-making process, consider the following aspects when evaluating alternative accounting software:

Wrap Up

Choosing the ideal accounting software is a cornerstone for businesses of all sizes, but navigating the vast ocean of options can be daunting. This comprehensive guide has meticulously compared Xero and QuickBooks, industry titans renowned for their robust features and scalability. However, to equip you for a genuinely globalised financial voyage, we've ventured beyond these giants, exploring the dynamic landscape of alternative accounting solutions.

In today's interconnected world, certain features are essential for your global business to navigate the financial seas with confidence:

Cloud-First Solutions: Prioritize cloud-based accounting software. This ensures real-time financial access from anywhere globally, fosters seamless collaboration across international teams, and safeguards your data with robust security measures. Operate with peace of mind, knowing your financial data is a click away, regardless of location.

Multi-currency Support: Embrace the global marketplace with software facilitating transactions and reporting in multiple currencies. Streamline international operations by effortlessly managing finances in your business's currencies. Reduce the complexities of foreign exchange calculations and ensure accurate financial insights.

Scalability and Integrations: Select a platform that effortlessly scales alongside your business growth. Seamless integration with third-party applications you rely on is crucial. Connect your accounting software with the tools that power your international endeavours to manage your global operations effectively.

The optimal accounting software hinges on your business needs, industry, and budget. Here's a breakdown to help you navigate the captain's deck:

Xero: Xero shines for its user-friendly interface, unlimited users on all plans, and robust features for project management and global businesses. Its intuitive design makes it a favourite amongst those new to the accounting world, while the unlimited user policy fosters seamless collaboration across international teams. Xero's robust multi-currency support empowers you to manage finances in multiple currencies, simplifying global transactions.

QuickBooks: QuickBooks caters to established businesses seeking a feature-rich platform with extensive customisation options. It boasts a well-established reputation and offers a vast library of integrations, allowing you to tailor the software to your needs. While user limitations on some plans might be a hurdle for larger teams, QuickBooks remains a powerful contender.

Don't be limited by the traditional heavyweights. Explore the dynamic world of alternative accounting software programs. Industry-specific solutions cater to unique needs, while cloud-based options prioritise remote accessibility and collaboration. Here's where solutions like FreshBooks and Wave can be compelling options for budget-conscious freelancers and startups.

Regardless of your chosen platform (Xero, QuickBooks, or an alternative), consider integrating robust solutions like SaasAnt Transactions and PayTraQer to further streamline your global financial processes.

SaasAnt Transactions: This integration seamlessly bridges the gap between Xero or QuickBooks and Excel, CSV, or PDF files. Import, export, and even delete transactions effortlessly, eliminating manual data entry and expediting reconciliation, especially when managing multiple international bank accounts. Save valuable time and minimise errors, ensuring your financial data accurately reflects your global operations.

PayTraQer: If your business relies heavily on online payments and e-commerce sales across borders, PayTraQer can be a game-changer. This integration bridges your accounting software, popular payment processors like Stripe, PayPal, and Square, and marketplaces like Amazon and eBay. PayTraQer automates the synchronisation of sales data, fees, refunds, taxes, and expenses across all your international transactions, ensuring your accounting software reflects a real-time picture of your global finances.

By carefully considering your business needs, leveraging the valuable insights provided in this guide, and thoroughly evaluating the features and functionalities of both industry leaders and alternative solutions. The perfect accounting software awaits, ready to streamline your financial processes, propel your business growth across borders, and empower informed financial decision-making globally. Set sail confidently, knowing you have the right tools and knowledge to navigate the exciting global business world!

FAQs

What Is the Best Accounting Software for Small Businesses?

There isn't a single "best" accounting software, but the two leaders are Xero and QuickBooks. The best choice for your business depends on your specific needs and budget. Xero is known for its ease of use and unlimited users on all plans, while QuickBooks offers a broader range of features and integrations.

What Features Should I Look for in Accounting Software?

Consider the size and complexity of your business and your industry. Essential features include invoicing, expense tracking, bank reconciliation, reporting, and inventory management (if applicable). If you operate internationally, look for software with multi-currency support.

Is Cloud-Based Accounting Software Better?

Cloud-based accounting software offers several advantages, including remote access, automatic data backup, and easier collaboration. However, some businesses prefer the security of a desktop-based program.

Xero vs. Quickbooks: Which Is Easier to Use?

Xero is generally easier to use, especially for those new to accounting software. QuickBooks has a more complex interface but offers more customisation options.

Is Xero or Quickbooks Cheaper?

Xero's plans are cheaper than QuickBooks, especially for businesses with multiple users. However, the actual cost depends on the features you need.

Which Is Better for Freelancers: Xero or Quickbooks?

Xero's unlimited user policy makes it a good option for freelancers collaborating with contractors or virtual assistants. QuickBooks' Simple Start plan might seem tempting due to its lower price, but it only allows one user.

What Are Some Alternatives to Xero and Quickbooks?

Popular alternatives include FreshBooks, Wave, Zoho Books, and Sage Business Cloud Accounting. These programs often cater to specific needs, such as freelancers (FreshBooks, Wave) or e-commerce businesses (Zoho Books).

Is Free Accounting Software Any Good?

Free accounting software programs like Wave can be a good option for startups or businesses with straightforward needs. However, they often have limitations on features or number of users.

What Are Some Industry-Specific Accounting Software Programs?

Accounting software programs are designed for specific industries, such as construction, e-commerce, and nonprofits. These programs offer features tailored to those industries' unique needs.