Payroll Journal Entry Examples in QuickBooks

Payroll is a highly sensitive and recurring accounting procedure for any business. A slight error in the recording of wages, deductions, or taxes can rapidly lead to issues in reporting and risks related to compliance. Payroll journal entries in QuickBooks are instrumental in ensuring that employee compensation, statutory deductions, and employer contributions are correctly documented in your financial records. Whether you are utilizing QuickBooks Online or QuickBooks Desktop, it is crucial to understand how to manually enter payroll journal entries when payroll is processed outside of QuickBooks or when modifications are needed. This guide clearly outlines examples of payroll journal entries, helping you maintain organized books and reliable payroll reporting.

This blog is ideal for accountants, bookkeepers, and small business owners who handle payroll outside of QuickBooks and require easy, dependable payroll journal entry examples for both QuickBooks Online and Desktop.

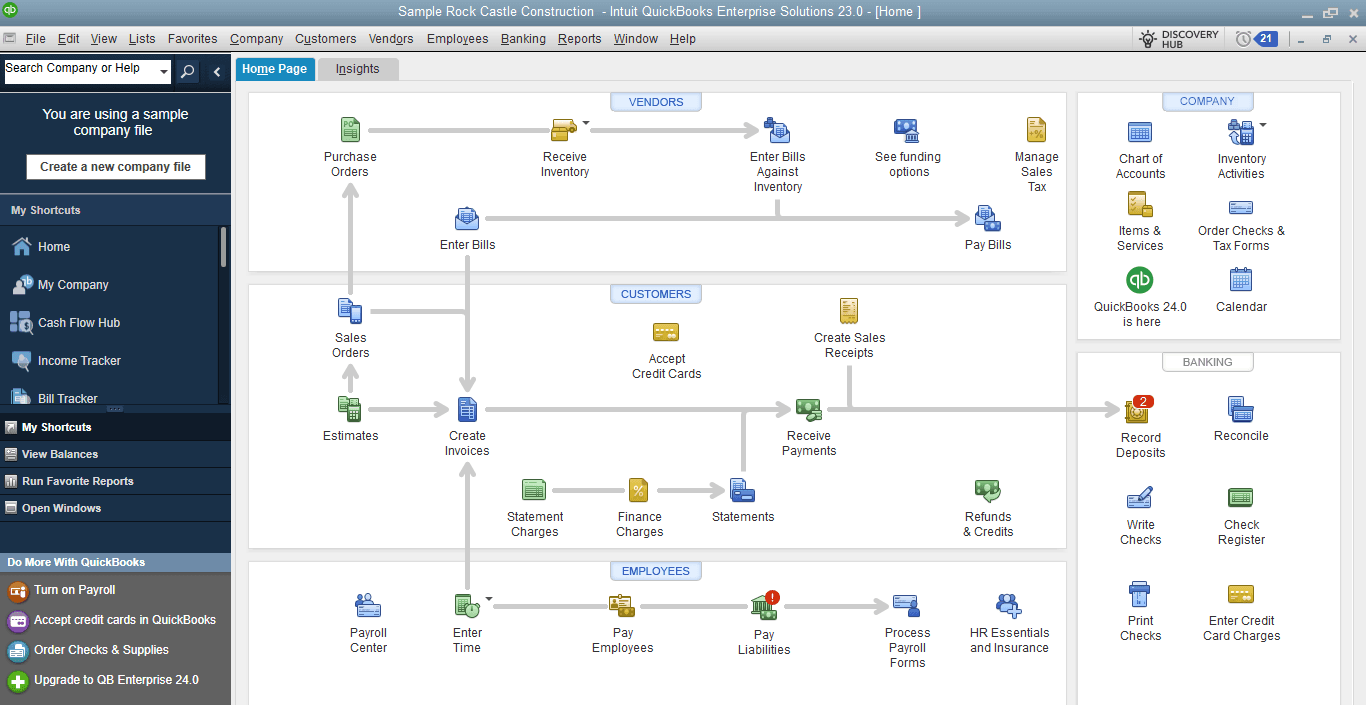

Recording Payroll in QuickBooks

QuickBooks Desktop and QuickBooks Online offer different ways to record payroll, whether you use their built-in payroll module, a third-party service, or enter everything manually. It’s essential to understand the right steps, account structure, and when to use liability accounts—especially for compliance and clarity.

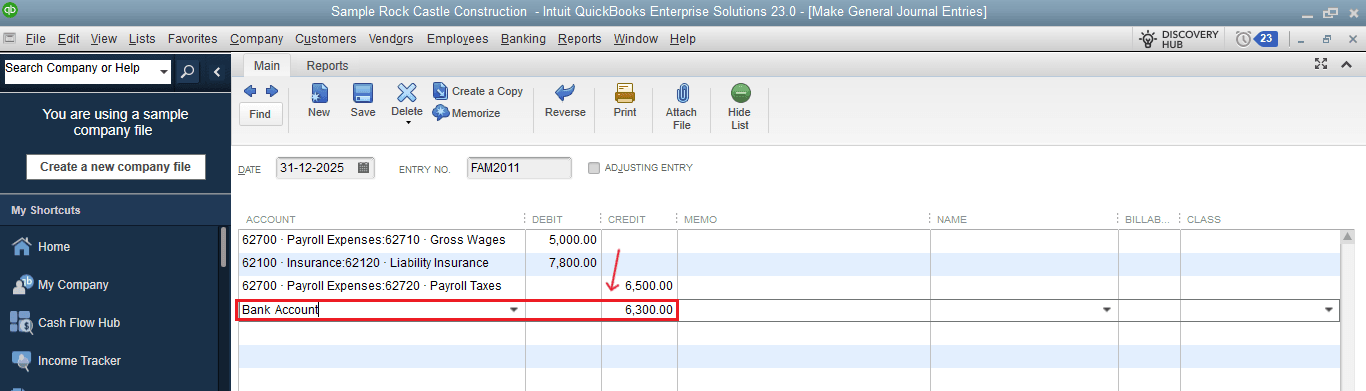

Payroll Journal Entry in QuickBooks Desktop

Step 1: Open QuickBooks Desktop

Open QuickBooks Desktop and log in to your company file with your credentials.

Make sure you are in the right company before making any payroll journal entries.

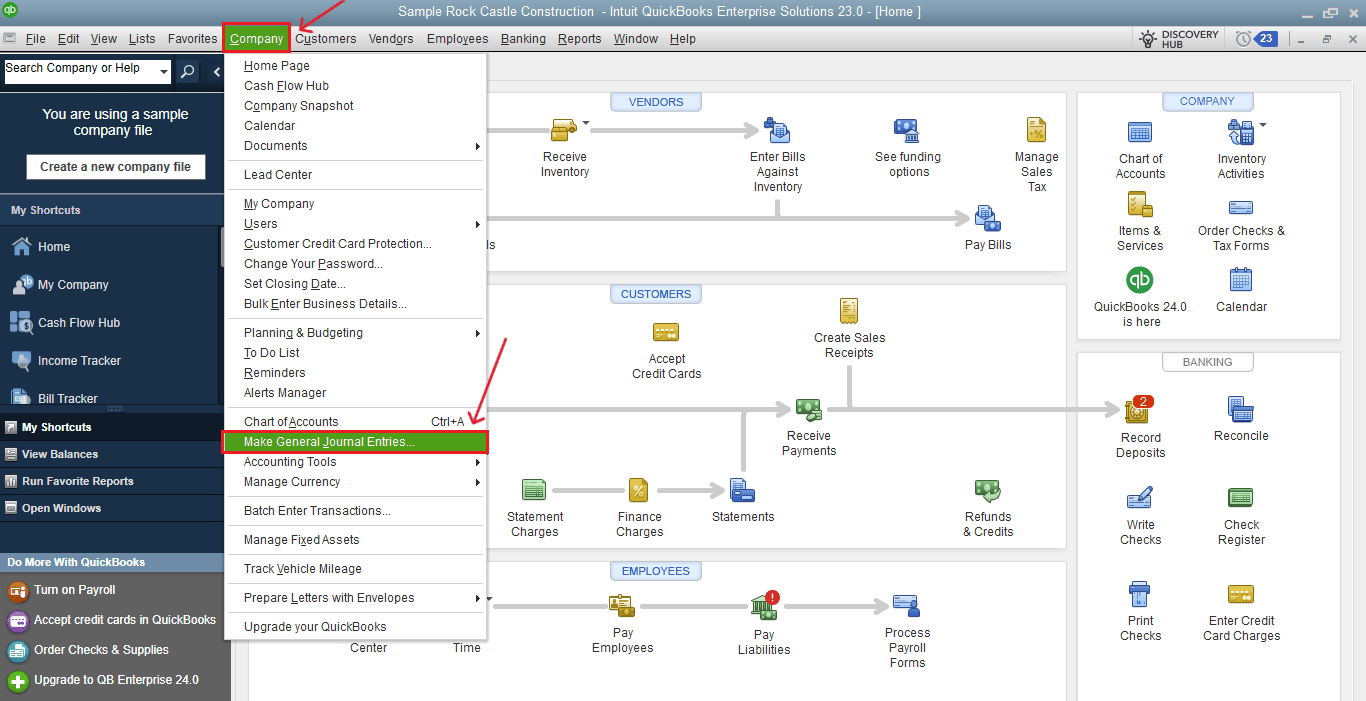

Step 2: Open General Journal Entry

Go to “Company” and select “Make General Journal Entries.”

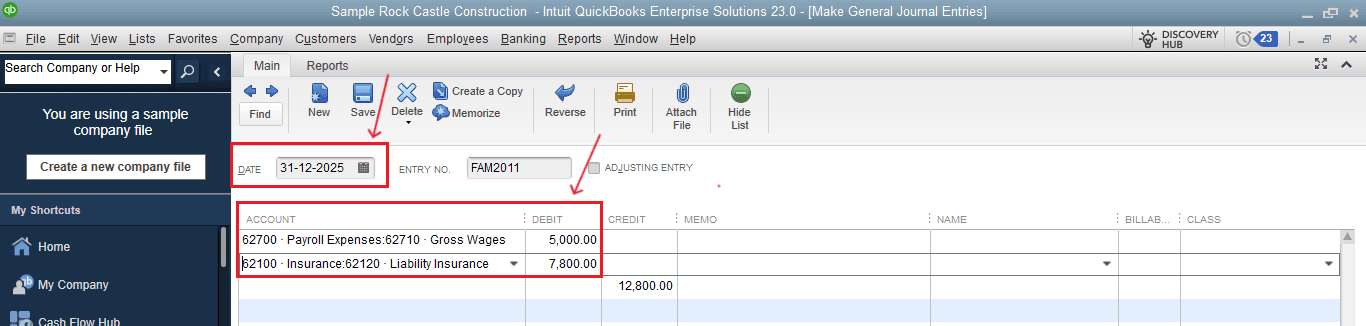

Step 3: Enter Gross Wages

Fill in the payroll date and a reference number for tracking purposes.

Charge the Wages Expense account with the total gross wages disbursed to employees. This step reflects payroll expenses for the accounting period.

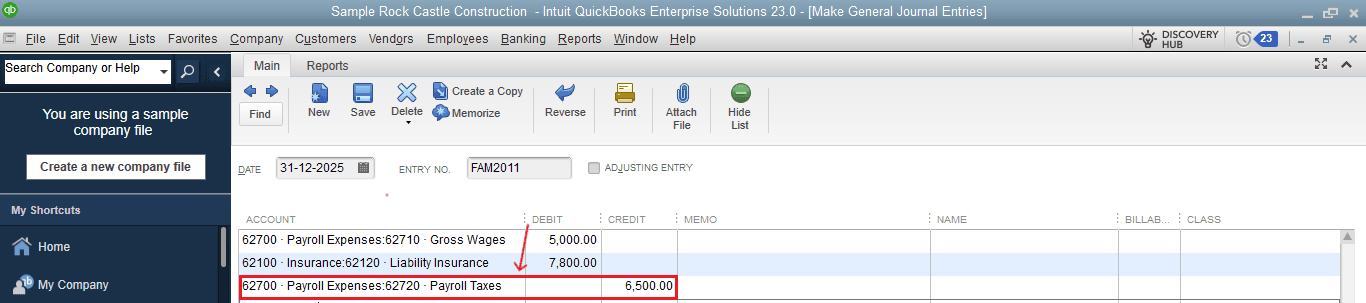

Step 4: Record Payroll Withholdings

Record Payroll Liabilities for employee deductions such as income tax, social security, or insurance. These are amounts that need to be paid to authorities.

Step 5: Record Net Pay

Credit the Bank account with the full amount of cash given to employees.

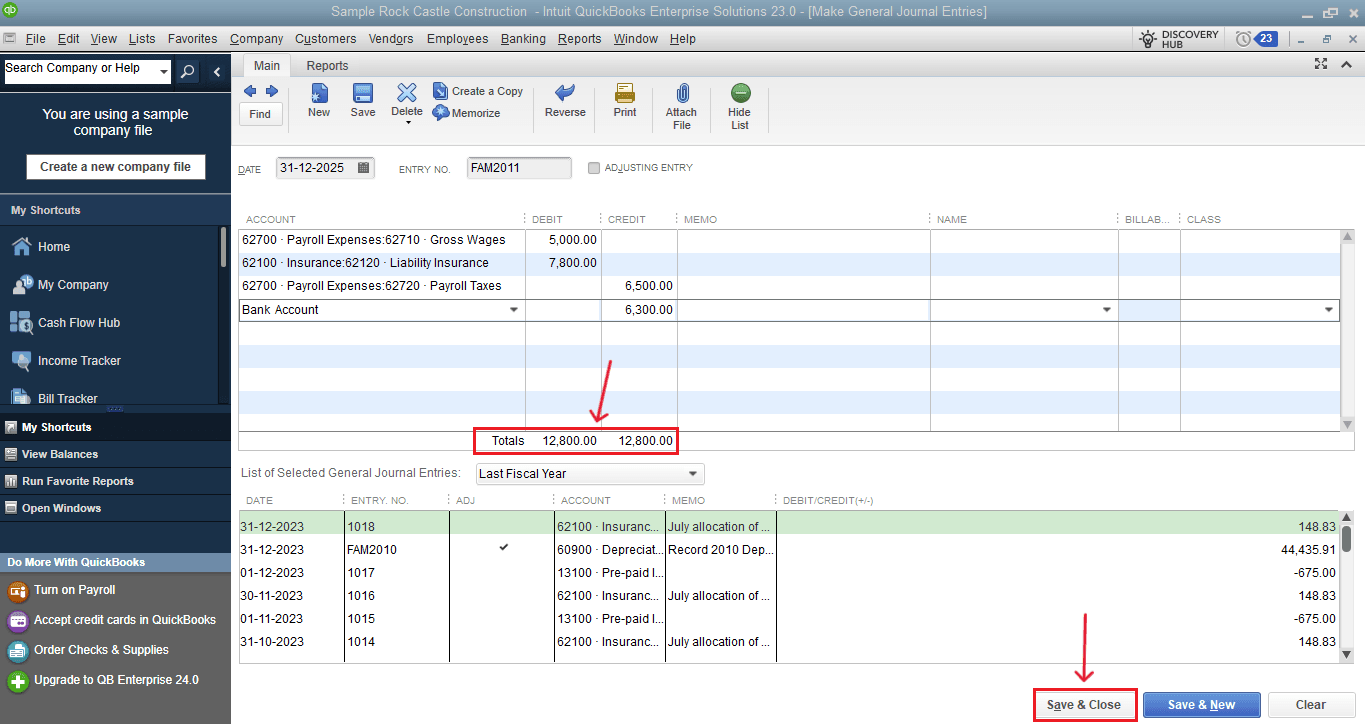

Step 6: Save and Review

Verify that total debits are equal to total credits before saving.

Click “Save and Close” the journal entry and check payroll liability and expense reports to ensure correct posting.

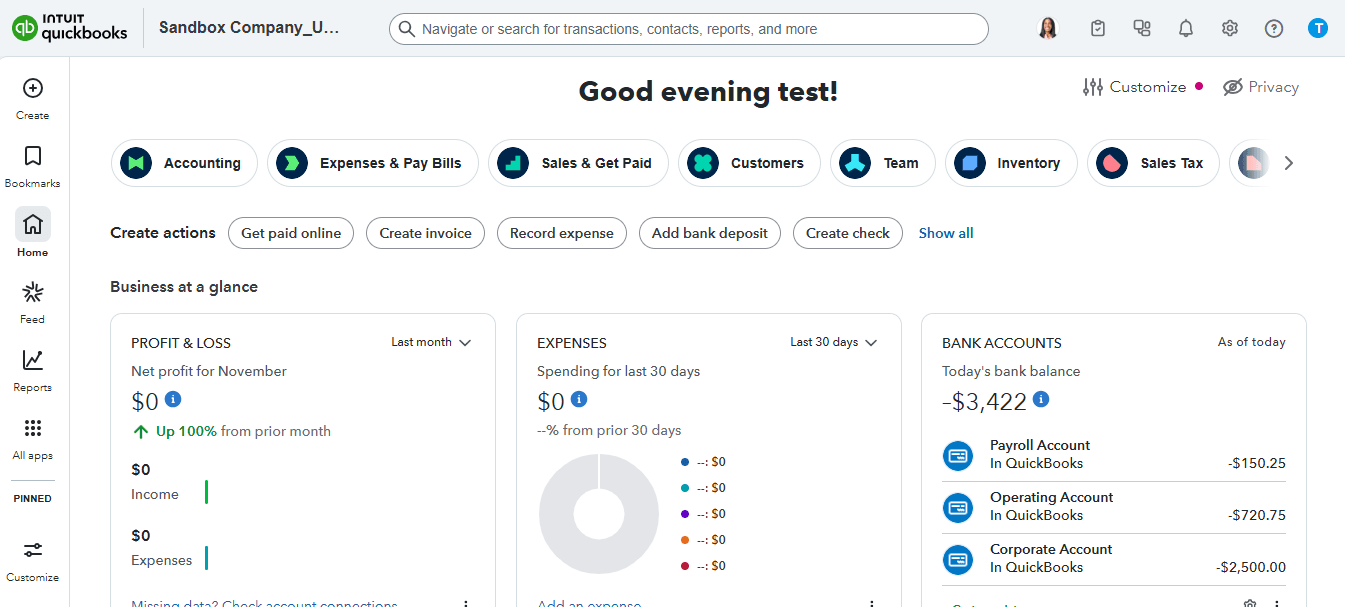

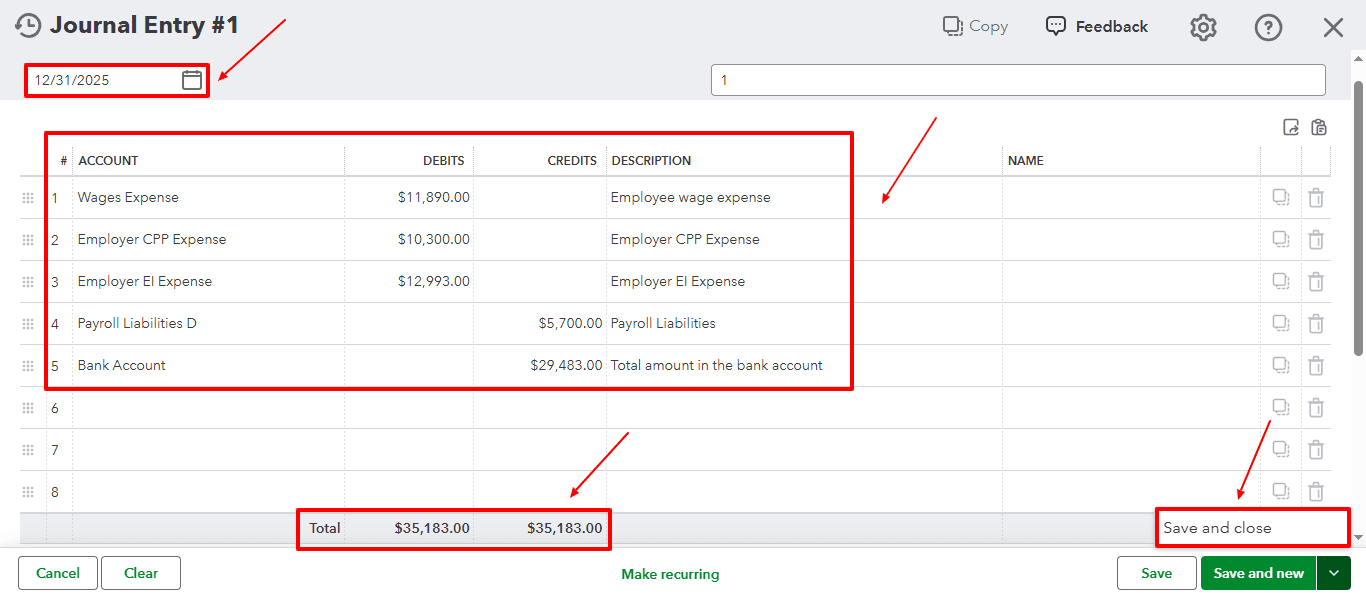

Payroll Journal Entry in QuickBooks Online

Step 1: Log In to Your QuickBooks Online Account

Log in to your QuickBooks Online account with your credentials.

Once you are on the dashboard, verify that you are in the correct company file.

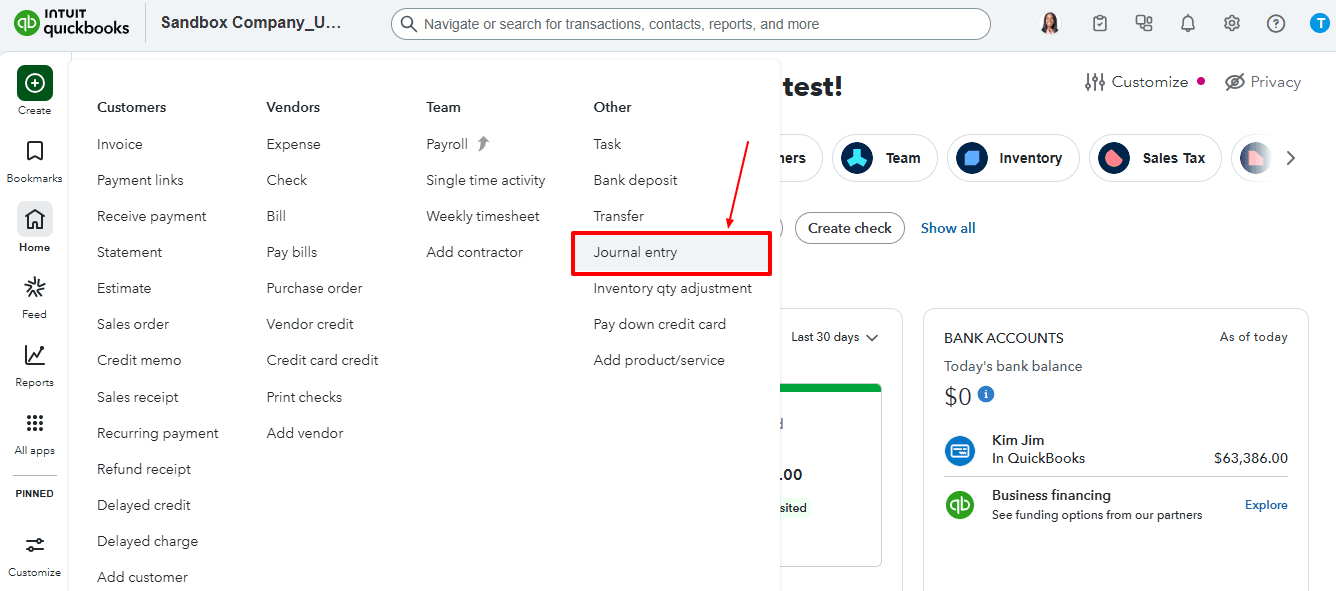

Step 2: Open the Journal Entry Screen

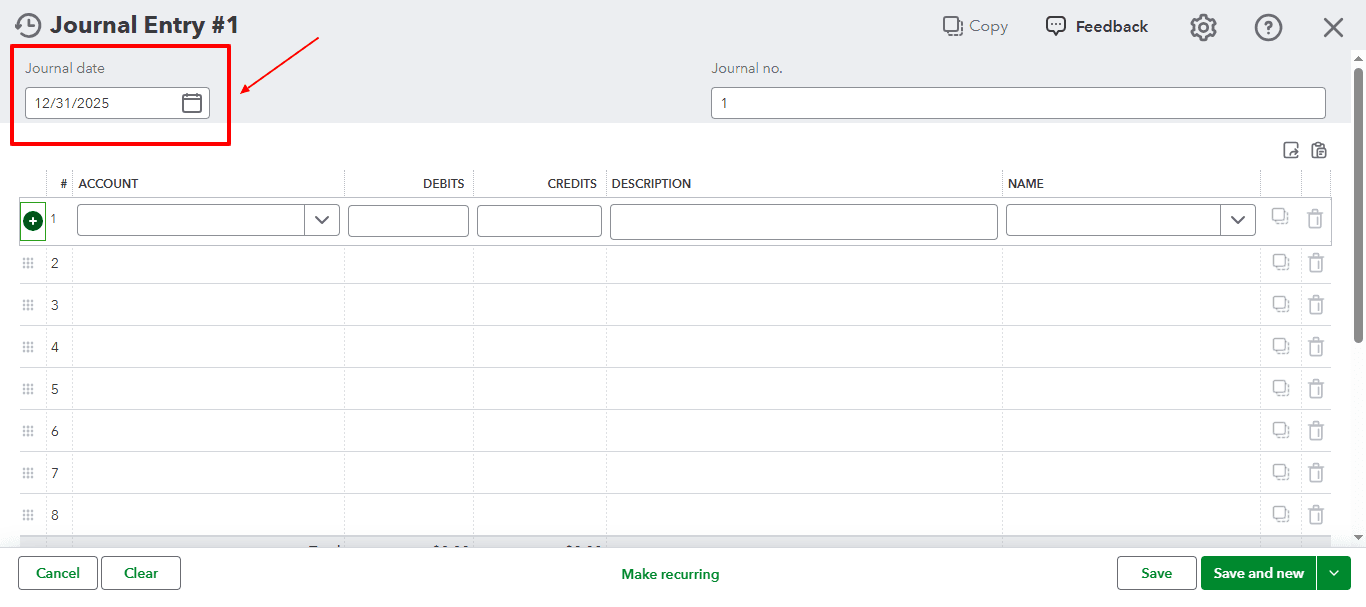

Click on “+ Create”, select “Journal Entry”.

Select the payroll date that aligns with the pay period you are entering.

Step 3: Record Gross Wages

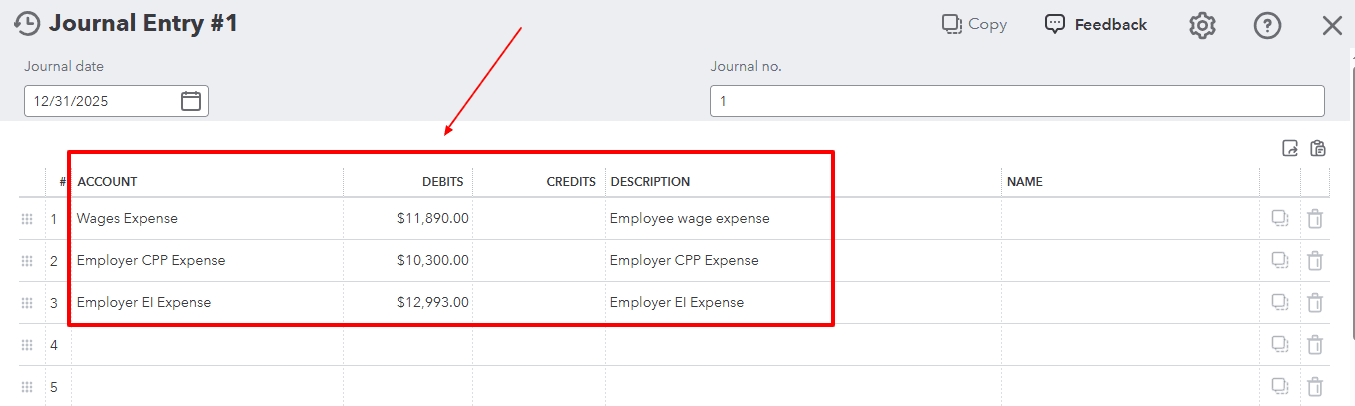

Record the total gross pay earned by employees in the Wages Expense account for the pay period. This indicates payroll costs on your Profit and Loss report.

Step 4: Record Payroll Deductions and Taxes

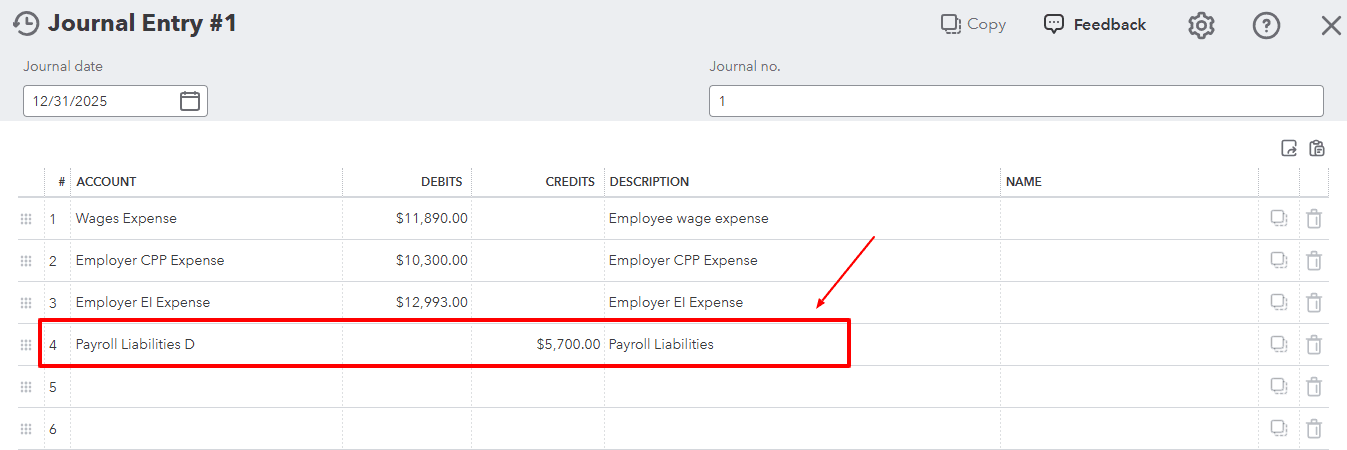

Credit Payroll Liability tracks employee deductions, including income tax, provident fund, and insurance.

Step 5: Record Net Pay and Employer Contributions

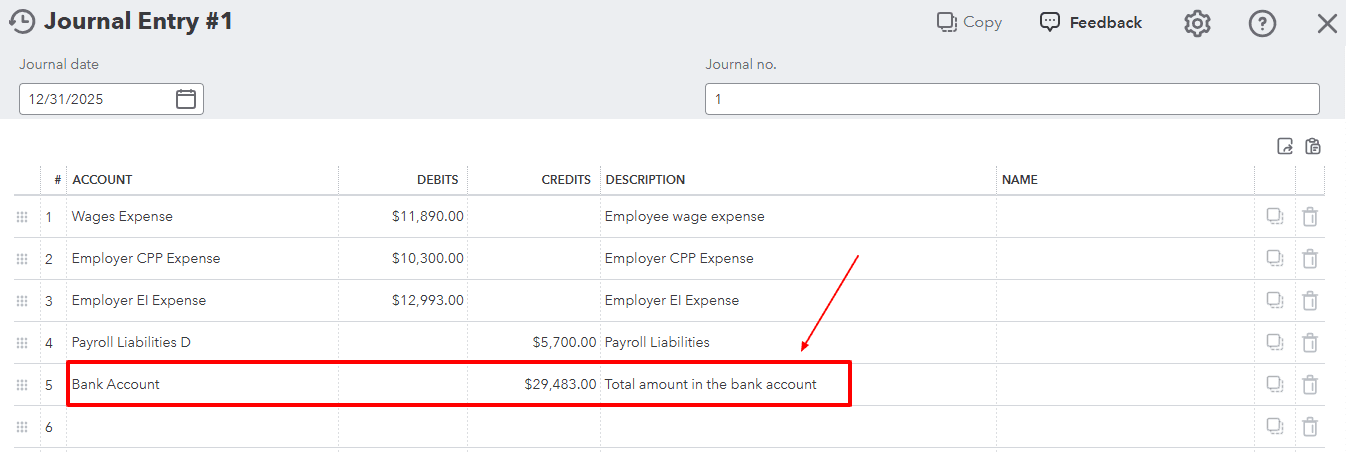

Credit the bank account for the net salary paid to employees.

Debit the employer payroll tax or benefit expense accounts separately to reflect the complete payroll cost.

Step 6: Review and Save

Provide a clear description, check debits and credits for balance, and then save the journal entry.

Check for accuracy using payroll and general ledger reports.

Click “Save and close.”

Integrating Third-Party Payroll (ADP Example)

If you use payroll processors like ADP, get the payroll report and record a journal entry matching their details:

Example Journal Entry:

Account | Debit | Credit |

|---|---|---|

Wages Expense | 20,000 | |

Employer Taxes Expense | 3,000 | |

Payroll Liabilities | 5,000 | |

Bank Account | 18,000 |

Handling Payroll Liabilities That Aren’t Paid Immediately

When you deduct amounts for taxes or benefits but won’t pay them right away, record them as a liability:

Account | Debit | Credit |

|---|---|---|

Payroll Tax Expense | 300 | |

Payroll Liabilities | 300 |

Later, when those taxes are paid:

Account | Debit | Credit |

|---|---|---|

Payroll Liabilities | 300 | |

Bank/Checking | 300 |

This approach keeps your books accurate by showing what you still need to pay.

Types of Payroll Journal Entries

There are three primary types of journal entries in payroll accounting:

Initial Recordings:

These entries record the wages earned by employees and all withholdings.

Example:

Debit "Wages Expense" $10,000

Credit "Employee Withholdings" $2,000

Credit "Net Payable to Employees" $8,000

Accrued Wages:

These entries record the wages owed to employees but not yet paid.

Example:

Debit "Wages Expense" $15,000

Credit "Accrued Wages" $15,000

Manual Payments:

These are entries for manual payments made to employees.

Example:

Debit "Accrued Wages" $15,000

Credit "Cash" $15,000

Accrued Payroll Journal Entry

Accrued payroll entries are made to recognize wages that employees have earned but have not yet been paid. For example:

Example Entry:

Employee Payroll Account (Debit) | $20,000

Accrued Wages (Credit) | $20,000

This entry would be made at the end of an accounting period to reflect unpaid wages.

General Ledger Payroll Journal Entry Example

A general ledger payroll journal entry in QuickBooks will show the employee’s gross wages and the associated payroll taxes. Here’s an example:

Example Entry:

Debit "Wages Expense" $10,000

Credit "Federal Tax Payable" $1,000

Credit "State Tax Payable" $500

Credit "Net Payable to Employees" $8,500

Categorizing Payroll in QuickBooks Online

In QuickBooks Online, payroll transactions are categorized based on payroll accounting preferences. You can edit your payroll settings to change the default accounts where payroll transactions are recorded.

Edit Payroll Settings:

Go to "Payroll Settings" and select "Accounting Preferences".

Change the default accounts for payroll expenses and liabilities as needed.

Review Transactions:

Regularly review payroll transactions to ensure they are categorized correctly.

Industry-Specific Examples

Construction: Split entries for overtime, union dues, and benefits.

Retail: Record commissions, bonuses, or final pays for terminated staff.

Technology: Include special lines for stock options, bonuses, and deferred comp plans.

Common Payroll Journal Entry Issues (Learned from Community Experience)

Employee vs Employer Taxes: Only employer taxes should appear as expenses; employee tax deductions are liabilities you pay later.

Net Pay/Gross Pay Confusion: Match net pay in the bank account to gross wages (minus withholdings) using detailed payroll reports.

Manual Entry Errors: Forgetting to update liability accounts can lead to off-balance books; always review journal entries and reconciliations.

Timing Issues: Seasonal industries often need to record draws or adjustments before final payroll.

Best Practices for Payroll Journal Entries

Use a Consistent Payroll Structure

Maintain a consistent format for every payroll journal entry. Use identical expense, liability, and bank accounts for each pay period to ensure uniformity. This strategy makes payroll reports more straightforward to review and eases the reconciliation process at both month-end and year-end.

Separate Expenses and Liabilities Clearly

It is essential to differentiate between payroll expenses and payroll liabilities. Gross wages, along with employer taxes, need to be classified as expenses, whereas employee deductions and withheld taxes must be recorded in liability accounts until they are paid off.

Record Payroll on the Correct Dates

Record payroll journal entries according to the payroll period rather than the payment date. Accruing payroll at the end of the month ensures expenses are properly aligned with the appropriate accounting period.

Reconcile With Payroll Reports

Verify journal entries by comparing them with payroll summaries provided by your payroll service. This process helps to eliminate discrepancies and ensures that your general ledger contains precise payroll data.

Review and Audit Regularly

Regularly check payroll records for mistakes or incorrect classifications. Frequent audits lower compliance risks and ensure financial statements are trustworthy.

Streamline Payroll Journal Entries with SaasAnt

SaasAnt Transactions is a powerful tool for importing multi-line journal entries into QuickBooks (Online or Desktop):

Import payroll entries in bulk from Excel or CSV.

Reduce manual errors with built-in validation.

Customize templates for simple or industry-specific payroll.

Edit or delete entries in batches.

Integrate with QuickBooks for automated, accurate posts.

Stop spending valuable time manually typing multi-line payroll entries into QuickBooks.

SaasAnt Transactions enables efficient, error-free imports to save time every pay period.

Read also

How to Delete Journal Entry in QuickBooks Online

Import Journal Entries into QuickBooks Online: Step by Step Guide

How to Edit Journal Entries in QuickBooks Online

Importing Journal Entries into QuickBooks Desktop from Excel