Everything About PayPal Automatic Payments: A Complete Guide

PayPal is one of the most popular and reliable online payment platforms in the world, offering a range of features to make our lives easier. One of its many excellent features is called "Automatic Payments." Think of it as a magic jinx for handling your regular bills and subscriptions without the stress of forgetting deadlines or typing in your payment info repeatedly.

This guide will unravel how this spell works, why it's so handy, and how to stop it if needed. So, join us on this digital adventure where convenience meets control – it's all about PayPal Automatic Payments!

Understanding PayPal Automatic Payments

Before diving into the intricacies of PayPal Automatic Payments, let's clarify what they entail. Automatic Payments, often confused with pre-approved payments or subscriptions, are a unique PayPal feature that permits merchants to withdraw funds from your account on a predetermined schedule.

Below are a few more examples of expenses typically paid using automatic payments:

Utility bills

Car loan payments

Rent and mortgage payments

Insurance premiums

Subscription services

Tuition and student loans

Charitable donations

Credit card bills

By setting up automatic bill payments, it’s possible to avoid potential late fees, save time and penalties, and ensure payments within the due date.

How to Set up Automatic Payments?

Setting up automatic payments can vary depending on the company or biller, but here are general steps you can follow:

Start by identifying the recurring bills you want to automate.

Choose a payment method (bank account, credit card, etc.) and gather the necessary account information.

You can typically select automatic payment during the signup process if the option is available for new accounts.

If you have existing accounts, log in to the billing company's payment portal and look for the option to set up automatic payments. Contact their customer service to inquire about the auto-pay option if it's unavailable online.

When setting up automatic payments, monitor your accounts and billing statements regularly. Ensure that payments are processed correctly and sufficient funds are available in your payment account to cover the expenses.

Using your Bank's Online Bill Payment System

Use your bank's online bill payment system to pay your bills automatically. Specify the amount to pay, the recipient, and the payment schedule (e.g., monthly).

Authorize automatic deductions from your bank account to the billing company on the monthly specified date. Be aware that some banks allow payments even if there aren't enough funds in your account. It will lead to overdraft fees, so ensure your account has sufficient funds to cover automatic payments.

Using a Credit Card for Automatic Payments

Provide your credit card information to the biller to enable automatic payments. Some companies may charge a fee for using a credit card, so review the terms before setting up automatic payments.

Keep a close eye on your credit card statements to verify that payments are processed correctly. Only add payments to your credit card that you can manage and pay off to avoid accumulating debt and potential fees.

Setting up Automatic Payments Directly with the Biller:

Provide the biller with your bank or payment account information, including routing and account numbers. It will help set up automatic payments on the due date of your bills and automatically transfer the bill amount from your account accordingly.

Pros of Automatic Payments:

Save Time: Automatic payments eliminate the need to initiate monthly payments, saving you time and effort manually.

Avoid Late Fees and Penalties: Automatic payments can help you avoid late fees, penalties, and negative impacts on your credit score that may arise due to missed payments.

Schedule Flexible Payments: You can set up automatic payments to align with your preferred payment schedule, whether weekly, bi-weekly, or monthly.

Reduce Paperwork: Automatic payments reduce the need for paper checks, invoices, or receipts, making financial management more convenient and eco-friendly.

Discounts and Rewards: Some billers offer incentives, such as discounts or rewards, for using auto pay. For instance, you may receive a percentage of savings on recurring orders or subscriptions.

Cons of Automatic Payments

Overdraft Fees: If more funds are needed in your account to cover an automatic payment, overdraft fees may apply, leading to financial complications.

Forgetting Expenses: Once you've set up automatic payments, it's easy to forget about them, making it challenging to keep track of your expenses.

Continued Payments Despite Issues: Automatic payments may continue even if you're disputing a bill or experiencing problems with the service, which may require extra effort to rectify.

Updates for Bill Amount Changes: If the amount of your bill changes, you may need to update your automatic payment information to avoid underpaying or overpaying.

Cancellation Hassles: Canceling automatic payments can be a hassle, requiring you to contact the biller or your bank directly to terminate the arrangement.

Limited Payment Methods: Some billers may only offer automatic payments through specific payment methods, like credit cards or bank accounts, limiting your flexibility in paying.

How to Cancel Automatic Payments on PayPal?

Here is a step-by-step guide on how to stop automatic payments on PayPal:

Step 1: Log In to Your PayPal Account

Begin by visiting the PayPal website and logging in to your PayPal account using your credentials.

Step 2: Access Your Settings

Once logged in, navigate to your PayPal account's settings or profile section. It is typically located in the upper right-hand corner of the page, represented by a gear or cogwheel icon.

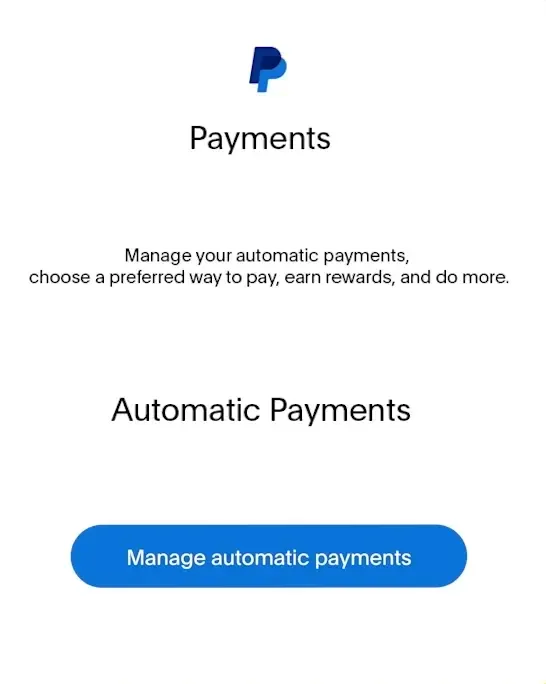

Step 3: Click on "Payments" or "Payments & Subscriptions"

In your settings or profile, look for an option related to payments. It may be "Payments" or "Payments & Subscriptions." Click on this option to access your payment settings.

Step 4: Manage Automatic Payments

Under the payments or subscriptions section, you should see an option to manage automatic payments or subscriptions. Click on this option to view a list of your active automatic payments.

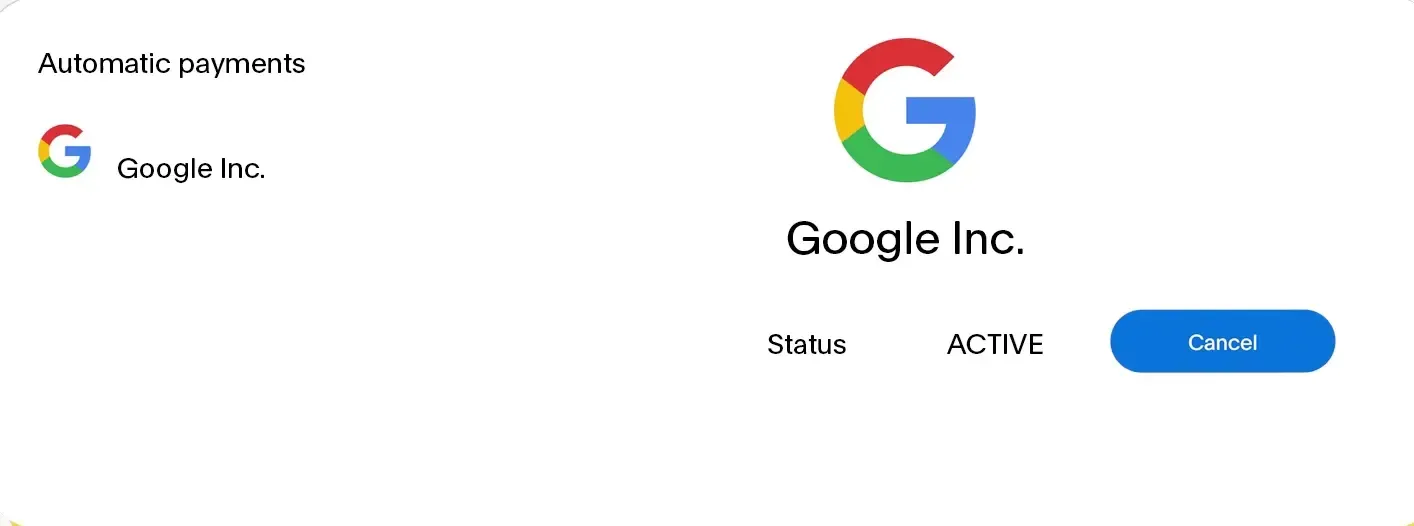

Step 5: Select the Payment to Stop

From the list of automatic payments, locate the one you wish to stop. Click on the payment to select it.

Step 6: Cancel or Turn Off

Once you've selected the payment, you'll typically see an option to cancel or turn off the automatic payment. Click on this option to initiate the cancellation process.

Once you've selected the payment, you'll typically see an option to cancel or turn off the automatic payment. Click on this option to initiate the cancellation process.

Step 7: Confirm Cancellation

PayPal may ask you to confirm the cancellation by clicking "Yes" or "Confirm." Confirm the cancellation to stop the automatic payment.

Step 8: Verify Cancellation

After confirmation, PayPal should confirm the cancellation of the automatic payment. It's a good practice to double-check your payment settings to ensure the payment is no longer active.

Automatic Payments offer undeniable convenience, ensuring you don't miss crucial payments or subscriptions. Yet, they may also raise concerns regarding financial control and privacy. It's essential to comprehend when and why you might need to stop these automatic payments and how to do it.

Why and When to Stop Automatic Payments?

Stopping automatic payments can be a crucial financial decision, and there are various scenarios where it becomes necessary:

Subscription No Longer Serves Your Needs: Your needs and preferences may change. The streaming service you once used religiously might no longer offer the content you're interested in, or a magazine subscription may have lost its appeal. In such cases, stop automatic payments to prevent spending on services that no longer bring value to your life.

Financial Constraints: Life can bring unexpected financial challenges, such as job loss, medical expenses, or unforeseen emergencies. During financial strain, reevaluating and temporarily stopping automatic payments can free up funds to address more pressing needs. It's a practical way to regain control over your budget.

Financial Control: Some individuals prefer a hands-on approach to their finances. They want to be deliberate about each payment they make and avoid automatic deductions. Stopping automatic payments aligns with this desire for greater financial control and awareness of where their money is going.

Preventing Overdrafts: Automatic payments can catch you off guard, leading to overdrafts or insufficient funds in your bank account. By stopping automatic payments and manually approving each transaction, you can avoid these unexpected charges and maintain a more stable financial situation.

Trial Periods Ending: Many subscription services offer free trial periods that automatically transition into paid subscriptions if not canceled. If you've tried a service and decided it's not for you, stopping automatic payments before the trial period ends can prevent unexpected charges.

10 Best Ways to Manage PayPal Automatic Payments

Manage your financial well-being and maintain control over your financial commitments with the help of the steps below.

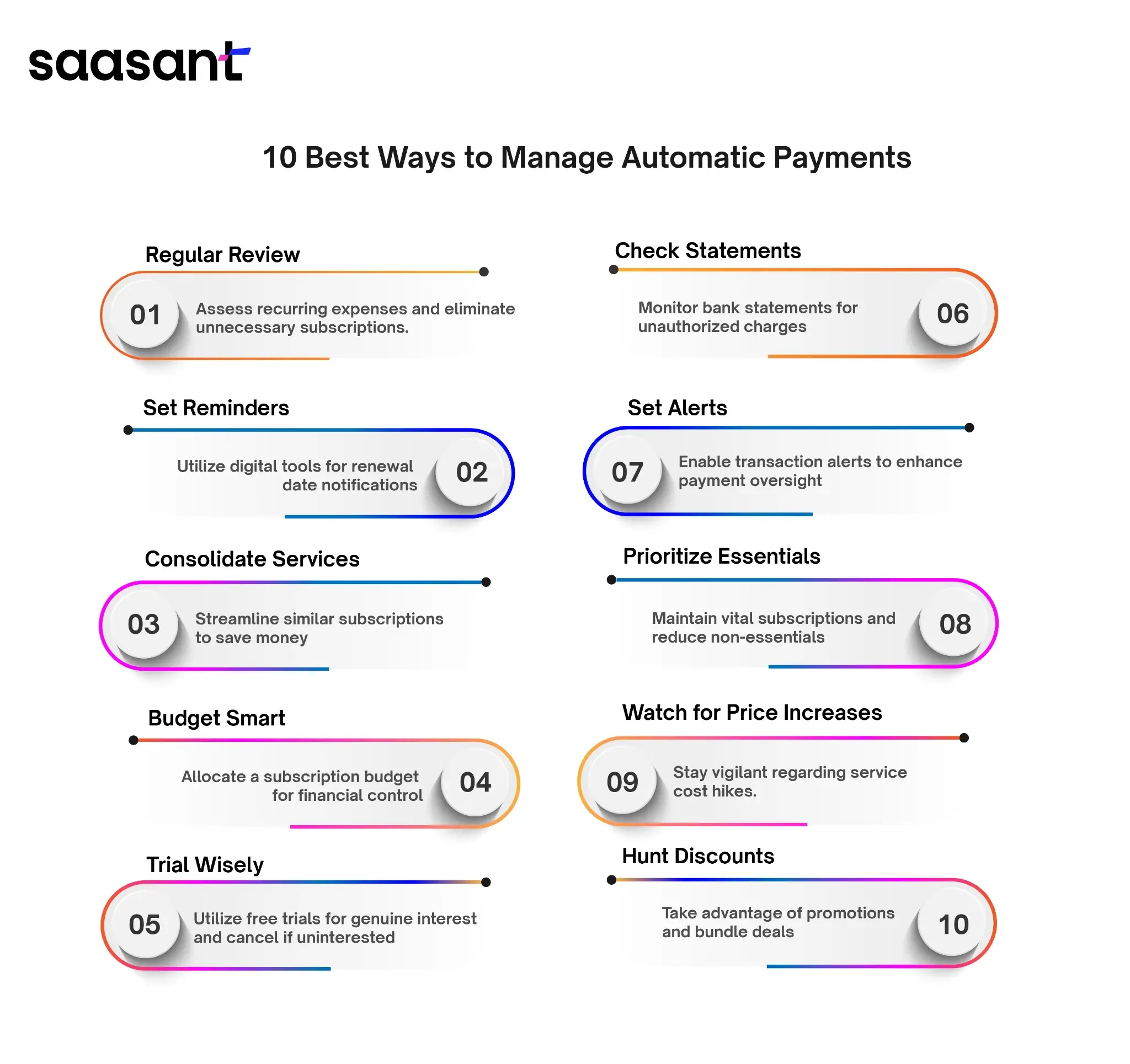

1. Regular Subscription Review: One of the most effective ways to manage subscriptions is by regularly reviewing them. Make it a habit to scrutinize your recurring expenses, including streaming services, software subscriptions, and memberships. Assess whether each subscription continues to provide value, and consider discontinuing those that no longer serve your needs, growth, and preferences.

2. Set Subscription Reminders: Subscriptions often renew automatically, catching many users off guard, so to avoid unexpected charges, set subscription reminders. Use digital calendar tools or reminders on your mobile device to alert you before a subscription renewal date. This proactive approach lets you decide whether to continue or cancel the service.

3. Consolidate Services: Over time, it's easy to accumulate multiple subscriptions for similar services. For example, you may have several streaming platforms or gym memberships. Consider consolidating these services to reduce redundancy and save money. Opt for a single, comprehensive service that meets your requirements.

4. Budget for Subscriptions: Include subscription costs in your monthly budget. By allocating a specific portion of your budget to subscriptions, you ensure that these expenses are accounted for and don't jeopardize your financial stability. It also helps you track your overall spending more effectively.

5. Use Trial Periods Wisely: Many services offer free, enticing trial periods. However, it's essential to use them cautiously. Only subscribe to trials for services you genuinely intend to explore, and be diligent about canceling before the trial converts into a paid subscription.

6. Review Billing Statements: Regularly review your bank and credit card statements. This practice allows you to spot any unauthorized or erroneous charges promptly. Contact your financial institution and the merchant to address the issue if you identify any discrepancies.

7. Set Up Alerts: Some financial institutions offer the option to set up alerts for specific transactions, including recurring payments. Configure these alerts to notify you whenever a recurring payment is processed. This added layer of oversight enhances your awareness of your financial commitments.

8. Prioritize Essential Subscriptions: Identify which subscriptions are essential for your lifestyle and well-being. Ensure these are maintained consistently and cancel Non-essential subscriptions when financial constraints require a tighter budget.

9. Monitor Price Increases: Some services may increase their subscription fees over time. Monitor price hikes and assess whether the value provided justifies the higher cost. If not, consider alternatives or negotiate with the service provider.

10. Seek Discounts and Promotions: Take advantage of service providers' discounts, promotions, and bundle offers. These can result in significant cost savings while allowing you to enjoy the services you value.

Comparative Analysis with Other Payment Methods

Comparing PayPal's automatic payment features with other payment platforms is essential in understanding the value and implications of using PayPal for managing your finances. Here's an expanded explanation of this comparison:

Understanding the Landscape: Before diving into the comparison, it's crucial to recognize that PayPal is just one player in the broader landscape of online payment platforms. Other platforms, such as credit cards, digital wallets (e.g., Apple Pay, Google Pay), and direct bank transfers, offer similar payment functionalities, each with features, advantages, and drawbacks.

PayPal's Automatic Payment Features: PayPal has gained popularity for its user-friendly interface and robust set of financial tools. Regarding automatic payments, PayPal provides a convenient way to manage subscriptions, recurring bills, and regular purchases. Its extensive merchant network and global reach make it a go-to choice for many users.

Credit Cards: Credit cards are a common alternative to PayPal for automatic payments. They offer various perks, including rewards programs and purchase protection. However, credit cards may encourage debt accumulation if not managed carefully, as they allow deferred payment. Users need to monitor their credit card balances to prevent overspending.

Digital Wallets: Digital wallets like Apple Pay and Google Pay provide a streamlined mobile payment experience. They excel in convenience, security, and integration with mobile devices. However, not all merchants accept digital wallets, limiting their usability. Additionally, they may offer a different level of subscription management than PayPal.

Direct Bank Transfers: Some users prefer direct bank transfers for automatic payments. While this method avoids fees associated with credit cards, it may need more flexibility and convenience than PayPal. Users must manually set up payments with each merchant, which can be time-consuming.

Long-Term Value and Implications: When evaluating PayPal's automatic payment features, consider fees, security, ease of use, and merchant acceptance. PayPal's fees may vary depending on the type of transaction and currency conversion, so it's essential to understand the cost implications. Security features like buyer protection and encryption are also crucial for safeguarding financial information.

The Value of Choice: The comparison ultimately highlights the value of choice. Different users have unique preferences and priorities regarding managing their finances. PayPal's automatic payment features align perfectly with one user's needs, while another may find credit cards or digital wallets more suitable. Understanding these distinctions empowers you to make informed decisions about your financial management tools.

PayPal's Policies and Security Features

Any user must understand PayPal's policies and security features, especially when managing automatic payments.

1.PayPal Goods and Services

Before diving into Buyer and Seller Protection, know about PayPal Goods and Services, a payment option provided by PayPal. It is one of the two payment types offered by PayPal, the other being PayPal Friends and Family. Now, let us know about its two essential features: buyer and seller protection.

Buyer Protection:

PayPal offers Buyer Protection for transactions conducted through its platform. This protection can be reassuring when making online purchases.

It covers eligible transactions if the item doesn't arrive or match the seller's description.

To fully benefit from this protection when needed, it's essential to familiarize yourself with the eligibility criteria.

Seller Protection:

If you're a seller using PayPal, Seller Protection can provide valuable safeguards for your eligible sales.

It helps protect your sales against fraudulent claims, chargebacks, or reversals.

2. Privacy and Data Protection

Data Encryption: PayPal employs industry-standard encryption to protect your financial and personal information during transactions. It ensures that your data remains confidential and secure.

Privacy Policy: Review PayPal's Privacy Policy to understand how your data is collected, used, and shared. Knowing your privacy rights and options is essential for controlling your personal information.

3. Unauthorized Transactions

Zero Liability Policy: PayPal's Zero Liability Policy protects against unauthorized transactions, provided you report them promptly. This policy offers peace of mind in case your account is compromised.

4. Fraud Prevention

Security Alerts: PayPal may send you security alerts and notifications to inform you about your account activity. Stay vigilant and take immediate action if you receive any alerts related to suspicious activity.

Two-Factor Authentication (2FA): Enable 2FA for an extra layer of security. It requires you to enter a unique code sent to your mobile device when logging in or making specific changes to your account.

5. Refund and Dispute Resolution

Refund Policy: Understand PayPal's refund policy, especially regarding automatic payments. Knowing how refunds work can help you if you need to dispute a payment.

Dispute Resolution Center: PayPal provides a Dispute Resolution Center where you can open disputes, escalate claims, or report transaction problems. Familiarize yourself with this process in case you encounter issues with automatic payments.

6. Payment Authorization and Pre-approved Payments

Authorization for Automatic Payments: Be aware that when you set up automatic payments with a merchant or service, you are authorizing them to charge your PayPal account regularly. Review and manage these authorizations in your PayPal settings.

7. Consistent Account Monitoring

Regularly Review Transactions: Make it a habit to review your PayPal Transactions and account activity regularly. It can help you spot any unusual or unauthorized payments promptly.

8. Contact PayPal Support

Customer Support: PayPal provides customer support to assist users with account-related issues. If you encounter any problems or have questions about automatic payments, don't hesitate to contact their support team.

9. Keeping Information Updated

Maintain Accurate Information: Ensure that your contact information, including email addresses and phone numbers, is up to date in your PayPal account. It helps in communication and security verification.

Conclusion

Indeed, PayPal Automatic Payments can offer significant convenience for managing recurring financial commitments. However, using this convenience wisely is crucial to understanding PayPal's policies and security measures. With this knowledge, you can navigate the platform confidently and make automatic payments work to your advantage. You can take control of your financial world by following the practical steps outlined in this guide and staying informed about any changes in PayPal's policies and features. Financial empowerment comes not just from knowing but also from taking decisive action.

Do you need help keeping track of your online payments and managing PayPal goods and services? Here is PayTraQer, which syncs all your PayPal transactions and payments into QuickBooks, allowing you to monitor spending efficiently.

Frequently Asked Questions

What are automatic payments on PayPal?

Automatic payments on PayPal, also known as automatic billing agreements or recurring payments, allow you to set up a pre-authorized arrangement with a merchant or service provider. This agreement permits them to charge your PayPal account at specified intervals for ongoing subscriptions, memberships, or regular purchases without you manually initiating each payment. It's a convenient way to ensure your recurring expenses are paid automatically and on time. You can manage or cancel automatic payments through your PayPal account settings.

Can I Set Up Recurring Payments on PayPal?

Yes, you can set up recurring payments on PayPal. Use the "Automatic Payments" or "Billing Agreements" feature to schedule regular payments for bills, subscriptions, and more. It's a convenient way to ensure timely payments without manual transactions. Simply, log in to your PayPal account, set up the details, and manage your recurring payments effortlessly.

What are the risks of using automatic payments on PayPal?

One of the risks of using automatic payments on PayPal is that you may need to remember to cancel a payment that you no longer need. It could lead to overdraft fees or unauthorized charges. Reviewing your automatic payments regularly and canceling any that you no longer need is essential.

How do I set up an automatic payment on PayPal?

To set up an automatic payment, you must first find the merchant's website and select PayPal as your payment method. You will then log in to your PayPal account and authorize the payment.

How do I view and manage my automatic payments on PayPal?

You can view and manage your automatic payments by logging in to your PayPal account and going to the "Payments" tab. Click on "Manage pre-approved payments" to see a list of your automatic payments. Click on any payment to view the details or cancel it.

How do you cancel a recurring payment on PayPal?

Cancelling a recurring payment on PayPal is straightforward. Follow these steps:

Log In: Log in to your PayPal account using your credentials.

Navigate to "Automatic Payments”: Find the "Automatic Payments" or "Billing Agreements" section, typically located in the "Settings" or "Profile" area.

Locate the Recurring Payment: Identify the recurring payment or billing agreement you want to cancel from the list.

Cancel: Select the payment, then click the option to cancel or turn it off.

Confirm: PayPal will ask you to confirm the cancellation. Confirm it to stop the recurring payment.

Verification: Verify that the payment has been canceled by checking your list of automatic payments.

What do I do if I can't cancel an automatic payment on PayPal?

If you cannot cancel an automatic payment on PayPal, you can contact the merchant directly and ask them to cancel it. You can also contact PayPal customer support for assistance.

How do I prevent unauthorized automatic payments on PayPal?

You can do a few things to prevent unauthorized automatic payments on PayPal. First, be sure to set up automatic payments with trusted merchants. Second, review your automatic payments regularly and cancel any that you no longer need. Third, enable two-factor authentication on your PayPal account.

What are some alternative methods for stopping automatic payments on PayPal?

In addition to canceling an automatic payment through PayPal, you can contact the merchant directly and ask them to cancel it. You can also update your payment information with the merchant, preventing them from charging your PayPal account.

What are some alternative methods for stopping automatic payments on PayPal besides using your account settings?

To stop automatic payments on PayPal, you can use your account settings. Alternatively, consider these methods:

Contact the Merchant: Contact the service provider or merchant for assistance canceling recurring payments.

Update Payment Information: Ensure your payment methods are up-to-date to prevent interruptions due to expired information.

PayPal Resolution Center: File a dispute in the Resolution Center if you encounter issues, especially unauthorized billing.

Review Pre-approved Payments: Manage pre-approved payments in your PayPal settings to cancel them as needed.

Monitor Your Account: Monitor your PayPal account for unauthorized transactions and report them promptly.

Revoke Authorization: Contact PayPal's customer support to inquire about revoking authorization for unwanted automatic payments.

Dispute with Financial Institution: If all else fails, consider disputing the charge with your bank or credit card issuer for assistance in stopping the payment or recovering funds.

Tags

Read also

How to Verify a PayPal Account: Step-by-Step Guide to Getting a Verified PayPal Account

Can You Get Scammed On PayPal? How to Avoid PayPal Scams?

Can You Use PayPal on Amazon? Steps to Make Amazon Accept PayPal

Import PayPal Transactions into QuickBooks Online