How to Import Tax Rate in Xero

Navigating tax rate management in Xero needs efficiency, accuracy, and flexibility. While Xero’s standard import tools handle only basic tax rate entries, they are insufficient for businesses that operate across multiple regions, products, or complex tax regulations.

Xero does permit the import of Tax Rate, but its features come with several limitations that can affect your workflow:

No Bulk Importing: Xero does not allow bulk importing of multiple tax rates, so each rate must be created manually, which is tedious for businesses handling multiple jurisdictions or tax types.

File Format Restrictions: Only CSV files are accepted, and they must strictly comply with Xero’s column arrangement. A slight deviation, for instance, a missing comma or an incorrect header, will result in import failure.

Limited Error Handling: Xero does not verify data before upload. Problems such as absent tax codes or wrong rates require manual troubleshooting.

No Undo Option: When tax rate data is imported, Xero does not include a rollback feature. If there are incorrect entries, they need to be deleted and re-entered, which increases the risk of errors and inconsistencies.

Lack of Customisation: Users cannot map additional fields such as project codes, references, notes, or tags. This limitation limits detailed reporting and audit tracking.

These issues show that although Xero can manage tax rate imports, it is not optimised for speed, flexibility, or large-scale operations. This is where SaasAnt Transactions for Xero is useful. SaasAnt Transactions for Xero changes this by allowing bulk imports, adaptable field mapping, automated validation, and a one-click undo option. By incorporating SaasAnt, accountants, bookkeepers, and SMBs can simplify tax rate management, ensure compliance, and enhance financial accuracy, making tax administration quicker, more reliable, and scalable for any growing organisation.

Multi-Region Business Tax Management

A retail business operating across regions must apply different GST/VAT rates to its products and locations. Manually updating these rates in Xero can be tedious and error-prone, particularly during fiscal-year changes.

With SaasAnt Transactions for Xero, the company can:

Quickly import all tax rates for different states or product categories in just a few minutes.

Flexibly map fields to guarantee the correct alignment of tax types and percentages.

Automatically check data before uploading to prevent the need for rework.

Instantly reverse incorrect imports to keep financial records clean and compliant.

This enhances compliance, accuracy, and efficiency in tax operations.

This blog is suitable for accountants, bookkeepers, and small- to medium-sized business owners who use Xero and want quicker, more accurate methods for importing, editing, and managing bulk tax rates.

Contents

Multi-Region Business Tax Management

How to Import Tax Rate Into Xero

Why Choose SaasAnt Transactions for Xero?

Wrap Up

Frequently Asked Questions

How to Import Tax Rate Into Xero

Always back up your Xero Online data before you begin. Even though SaasAnt is designed to be safe and reliable, a backup provides an added layer of security. Follow the steps below to get started.

Step 1: Log In to Your Xero Account

Log in to your Xero account.

Step 2: Navigate to the Apps Menu

On the right side of the Xero dashboard, you can see the menu bar, which offers various options.

Select the “Waffle” icon. Click the dropdown and select “Find more apps on Xerp App Store.”

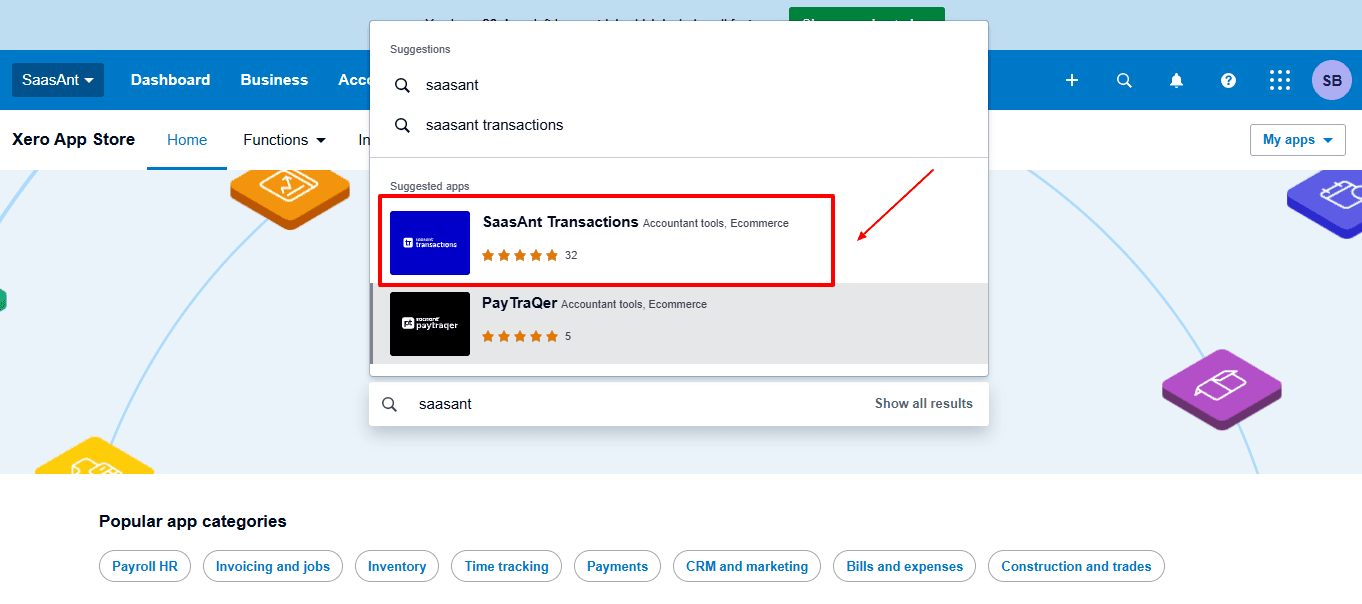

Step 3: Search SaasAnt Transactions

In the search bar, type “SaasAnt Transactions” as shown by the arrow in the image below.

Step 4: Open SaasAnt Transactions

Get the app from the App Store and connect it to Xero.

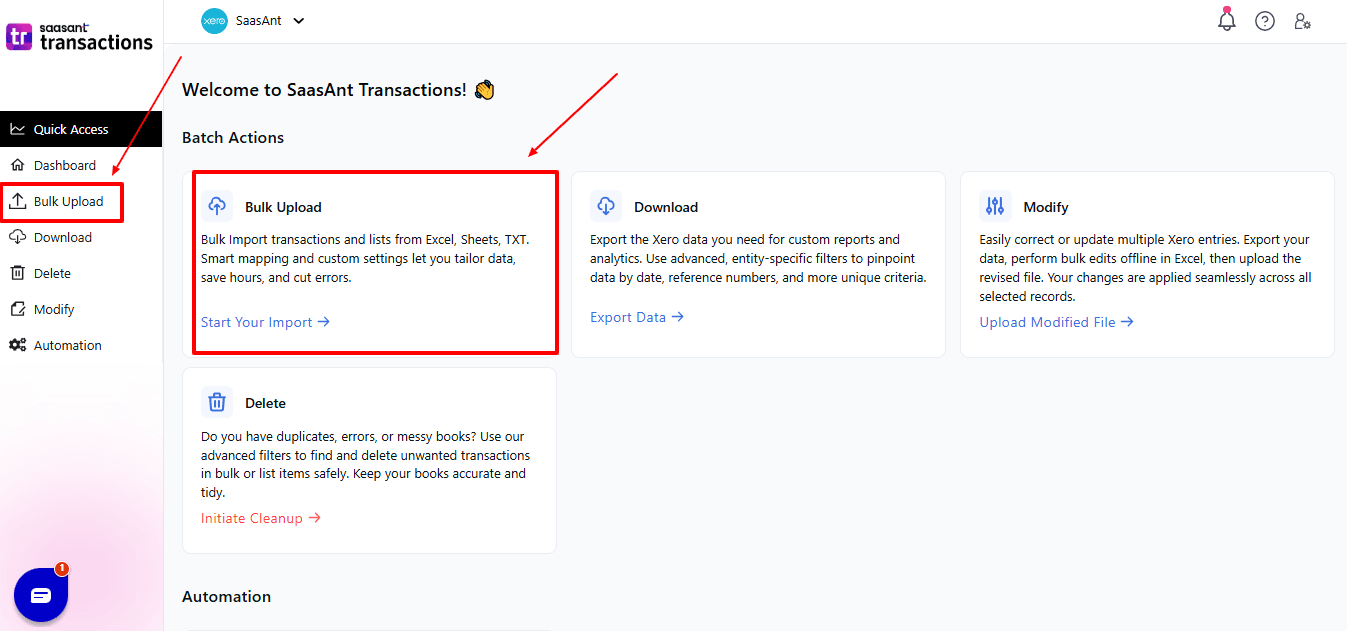

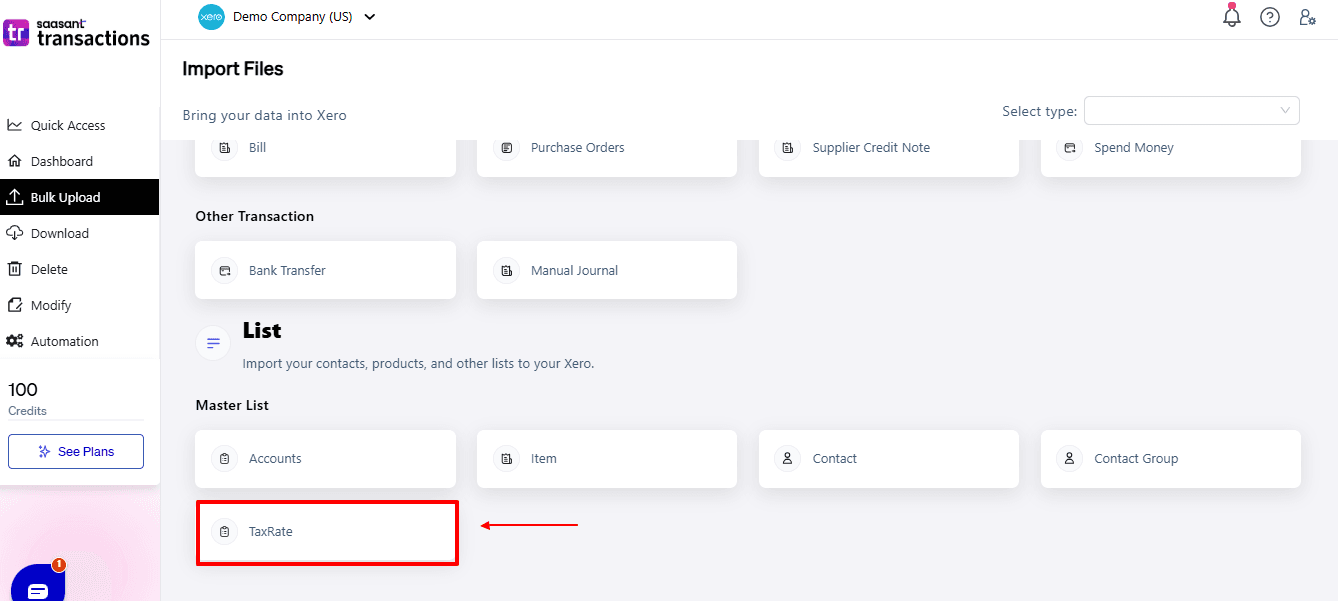

On the SaasAnt dashboard:

On the left side of the SaasAnt Transactions dashboard, you can see the menu bar with various options.

Select "Bulk Upload”

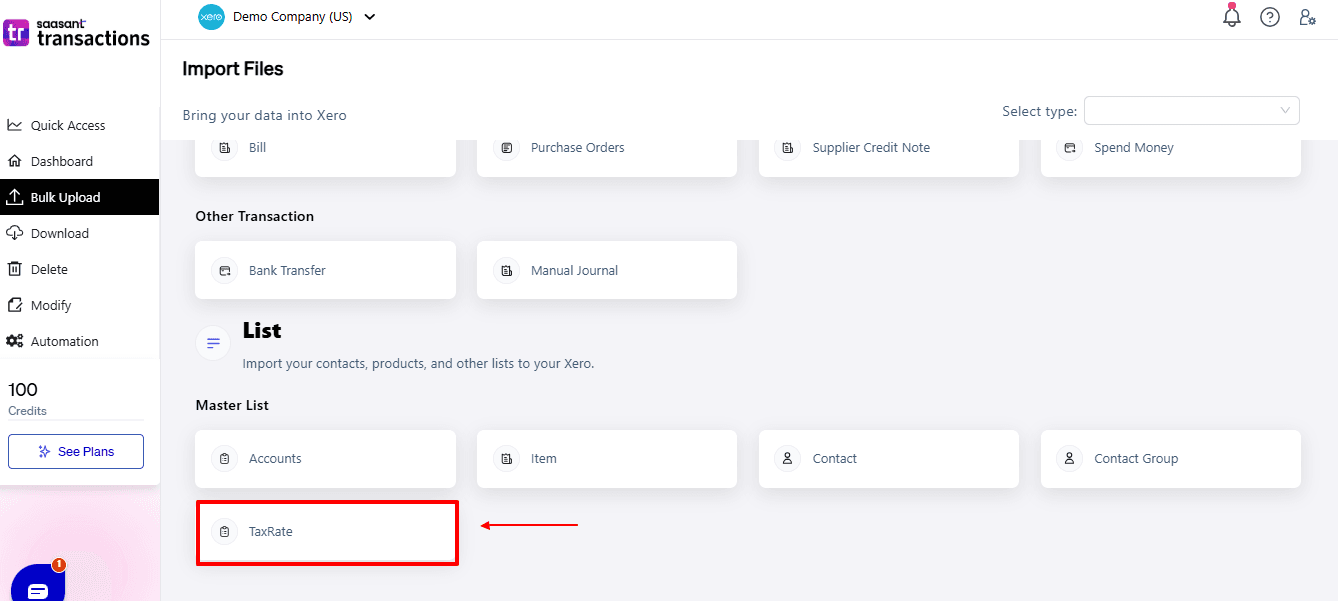

Now select “Tax Rate” from the other transaction.

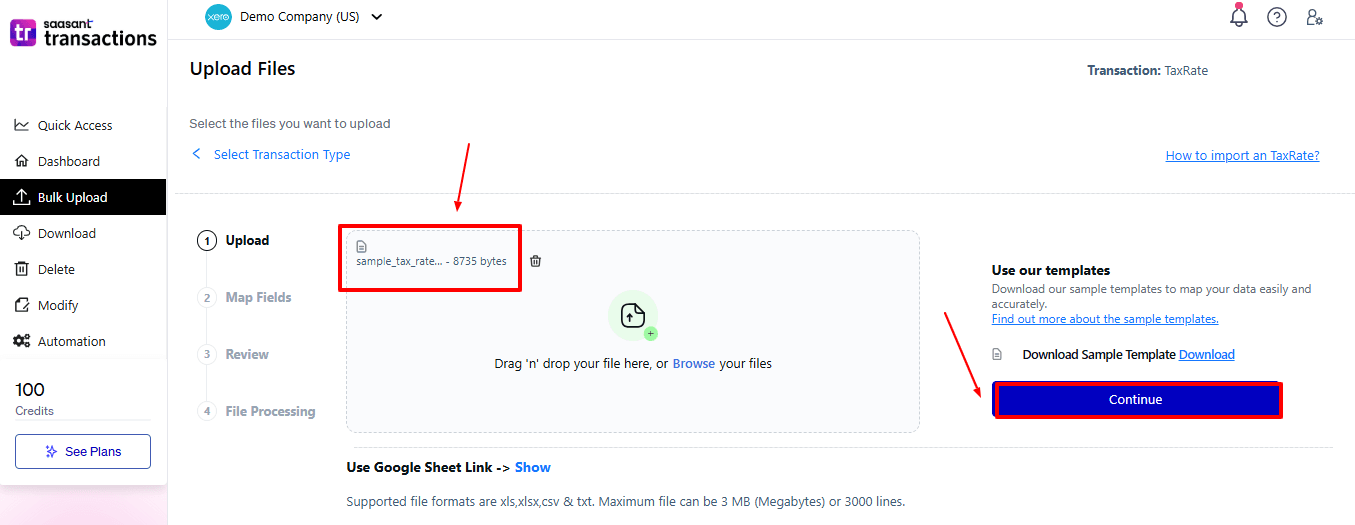

Now, upload your respective tax rate files from your device and click “Continue”.

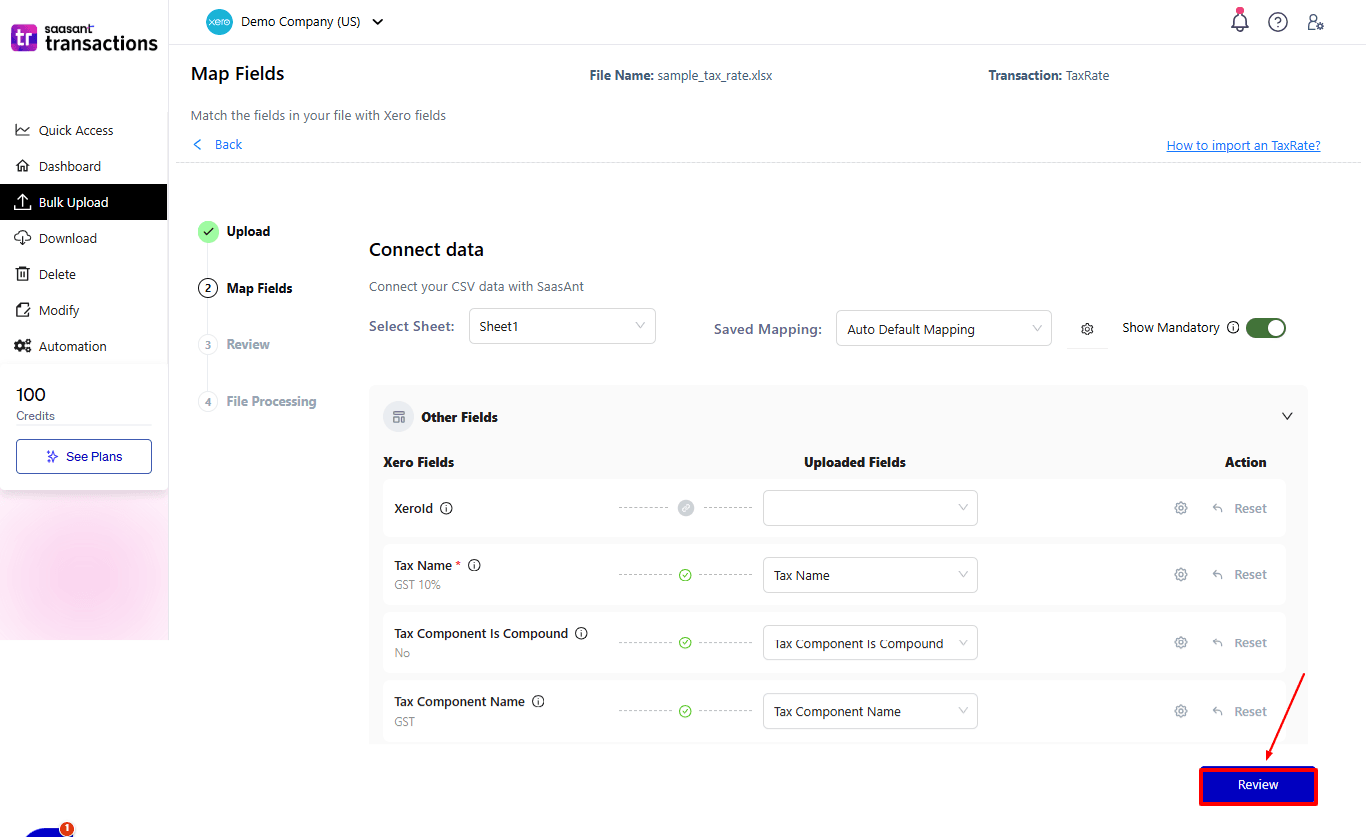

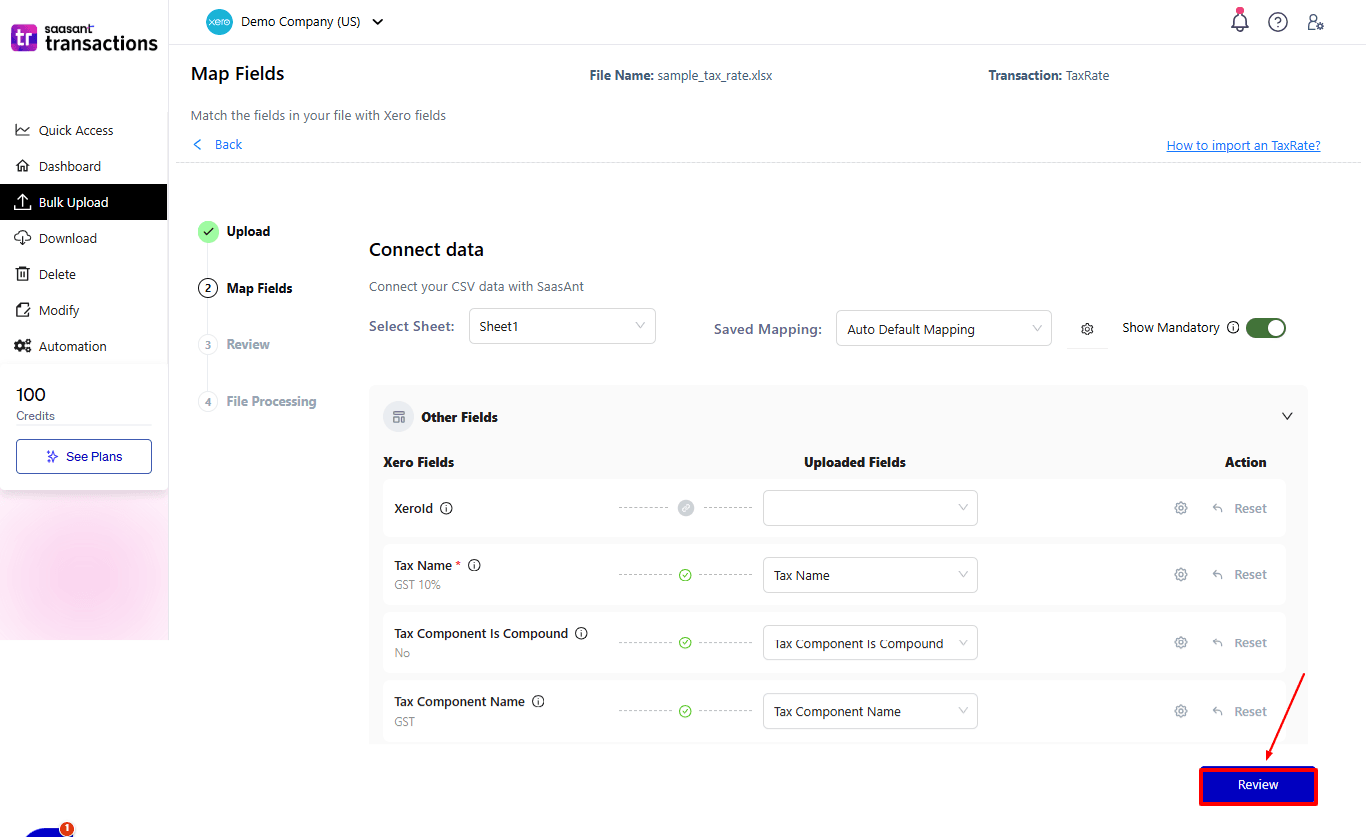

Step 5: Mapping Fields And Review

Ensures accurate mapping of essential fields: tax name, tax component, tax component name, etc.

The ‘Preview Mapping’ feature allows users to verify field alignment before review.

Select “Review” after finalising the mapping of all fields.

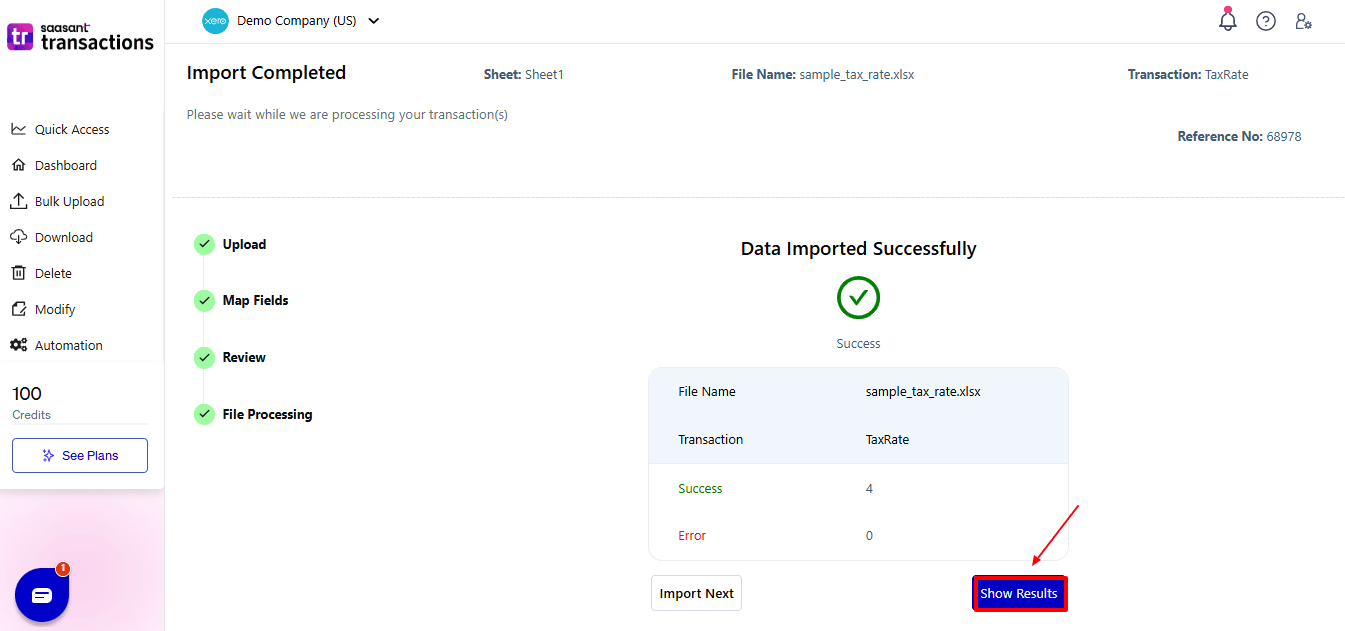

Step 6: Review And Upload

Review the Tax Rate and select “Upload”.

At the bottom left, there is a “Download” option, allowing you to save the tax rate for future reference.

Your tax rate data will be imported into Xero Online. Click “Show Results”.

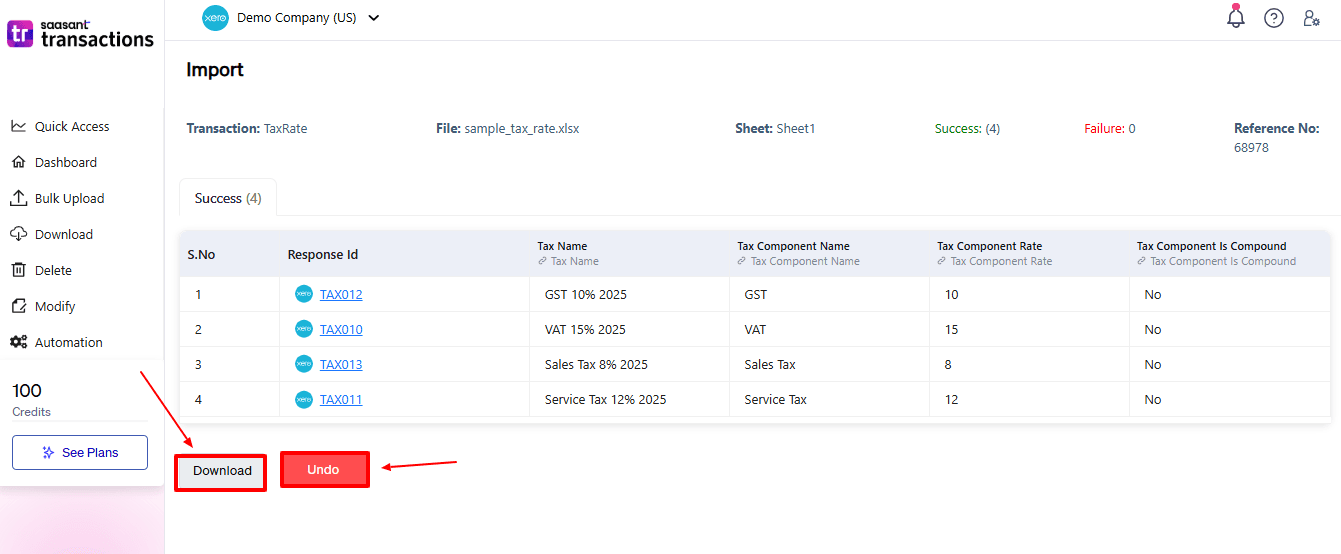

Step 7: Imported Data

Your imported tax rate data appears. At the bottom left, there is a “Download” option, which allows you to download your tax rate for future reference.

Additionally, next to the download option, you can see “Undo”, which allows you to roll back your tax rate.

Step 8: View Imported Data in Xero

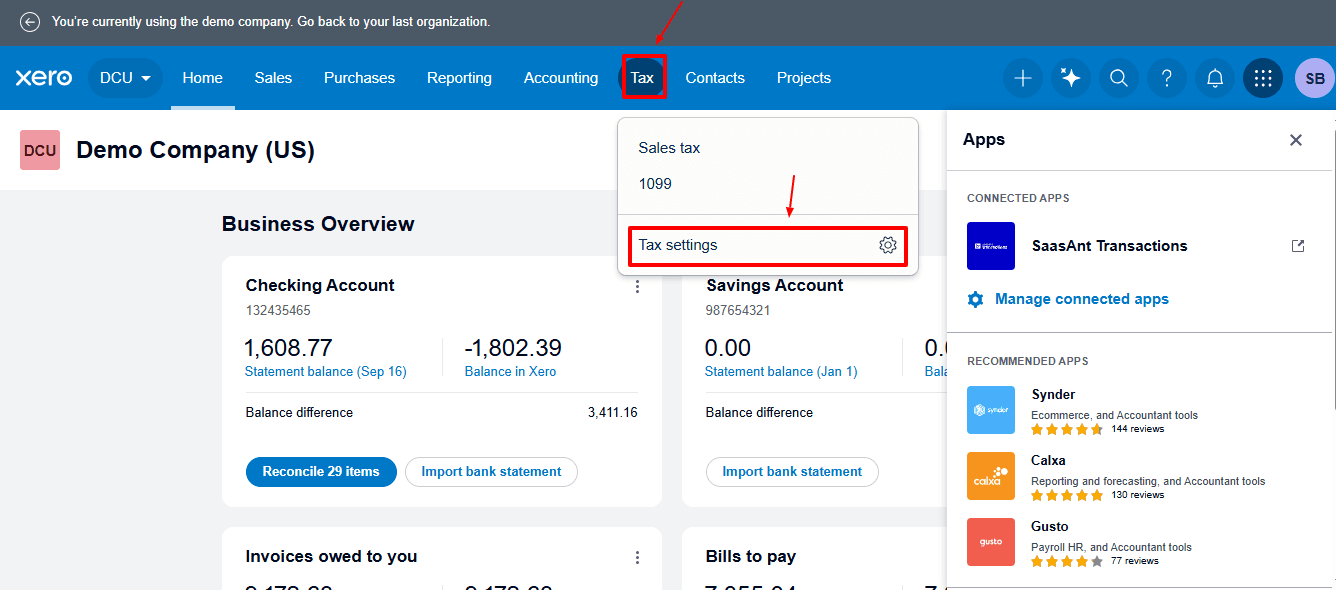

Now, back to the Xero dashboard, select “Tax” from the dropdown, and then select “Tax settings”

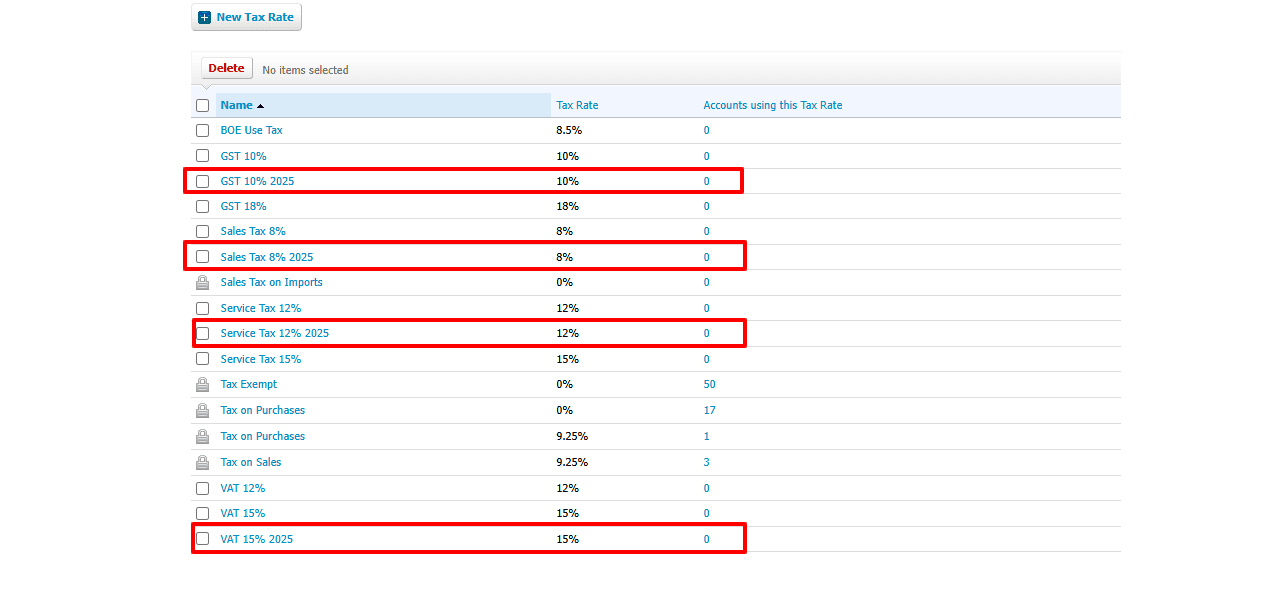

Now select “ Manual tax rates” as shown in the image below.

The import tax rates are displayed, as shown in the image below.

Why Choose SaasAnt Transactions for Xero?

When importing Tax Rates into Xero, accuracy, speed, and flexibility are crucial. While Xero offers a basic import option, it struggles with large datasets or complex tax structures. SaasAnt Transactions for Xero stands out with its strong automation and data management capabilities.

Bulk Import Features: With SaasAnt, businesses can import hundreds or even thousands of Tax Rate records in one go, significantly reducing the time spent compared to Xero’s method of entering each record individually.

Support for Multiple File Formats: Unlike Xero, which supports only CSV, SaasAnt can handle both CSV and Excel (XLSX) files, offering flexibility to work with different tools and systems without reformatting.

Flexible Field Mapping: Users can map fields from the source file —such as Tax Name, Tax Type, Rate, Status, and effective dates —to Xero fields, ensuring full accuracy and reducing the likelihood of errors during import.

Undo/Rollback Option: If incorrect data is imported, the one-click Undo feature reverses all changes, eliminating the need for manual deletion and reducing the risk of inconsistencies or reporting errors.

Error Detection and Validation: SaasAnt checks your Tax Rate data before you upload it, automatically finding any missing or incorrect fields. This helps avoid failed imports and guarantees clean, reliable data in Xero.

Wrap Up

Enhancing Tax Management in Xero requires efficiency, accuracy, and flexibility. While Xero’s native import tools only support basic tax rate entries, they are inadequate for businesses operating across multiple regions, products, or complex tax rules. SaasAnt Transactions for Xero revolutionises this by enabling bulk imports, flexible field mapping, automated validation, and a one-click undo feature, where businesses save hours of manual work, reduce errors, and keep audit-ready records.

By integrating SaasAnt, accountants, bookkeepers, and SMBs can streamline tax rate management, ensure compliance, and improve financial accuracy, making tax administration faster, more reliable, and scalable for any growing organisation.

If you have inquiries regarding our products, features, trial, or pricing, or if you require a personalised demo, contact our team today. We are ready to help you find the ideal solution for your Xero workflow.

Frequently Asked Questions

1) Can I import tax rates for multiple regions or jurisdictions in one file?

Yes. You can add columns for region, tax type, or jurisdiction and map them correctly in SaasAnt.

2) What file formats are available for importing tax rates?

SaasAnt is compatible with CSV and XLSX, offering flexibility for those using Excel or Google Sheets.

3) What if some tax rates in my CSV file are incorrect?

SaasAnt checks data for errors before import and highlights any issues, enabling accountants to make corrections before uploading to Xero.

4) What if I accidentally import incorrect tax rates?

SaasAnt provides a one-click undo option that lets users reverse any incorrect imports immediately.

5) How many tax rate entries can I import at once?

SaasAnt can handle hundreds or even thousands of tax rate entries, making it ideal for large accounting firms and small-to-medium-sized businesses with complex tax systems.

Read Also

How to Export Journal Entry in Xero

How to Import Quotes into Xero?

How to Import Receive Money in Xero

How to Import Invoices in Xero