A Comprehensive Guide to Handling Month-End Accruals in QuickBooks

Managing month-end accruals is a critical part of maintaining accurate financial records in QuickBooks. Each month, businesses must record expenses incurred but not yet paid and revenue earned but not yet billed. These entries ensure your financial statements accurately reflect your business performance for the reporting period.

This guide explains how to record and reverse month-end accruals in QuickBooks Online, and how SaasAnt Transactions automates accrual and reversal entries in bulk. Whether you are an accountant closing books for multiple clients or a business owner managing monthly reporting, this workflow simplifies the month-end close.

Contents

What Are Month-End Accruals in QuickBooks?

How to Add Month-End Accruals in QuickBooks?

Example of a Month-End Accrual

How to reverse month-end accruals in QuickBooks?

Tips to Identify Month-End Accruals

The Importance of Reversing Accruals

Automating Month-End Accruals with SaasAnt Transactions

Streamlining Reversal Entries with SaasAnt Transactions

Benefits of Managing Accruals with SaasAnt Transactions

Best Practices for Month-End Accrual Management

Final Thoughts

Frequently Asked Questions

What Are Month-End Accruals in QuickBooks?

Month-end accruals are accounting adjustments made to recognize income and expenses in the correct accounting period. For example, if you receive a utility bill in January for December usage, the expense should appear in December’s financials even though you will pay it later.

Why Accruals Matter

Accurate Reporting: Ensures income and expenses are recorded in the right period.

Compliance: Aligns with GAAP and other financial reporting standards.

Better Decision Making: Reflects a true picture of profitability each month.

In QuickBooks, you record these accruals through journal entries. However, if you handle multiple accounts or clients, manually entering each accrual can be time-consuming. This is where SaasAnt Transactions helps automate the process by importing multiple journal entries directly into QuickBooks.

How to Add Month-End Accruals in QuickBooks?

QuickBooks is a popular accounting software allowing you to add month-end accruals easily. The process involves creating journal entries for each accrual and posting them to the appropriate accounts. Here are the steps to follow:

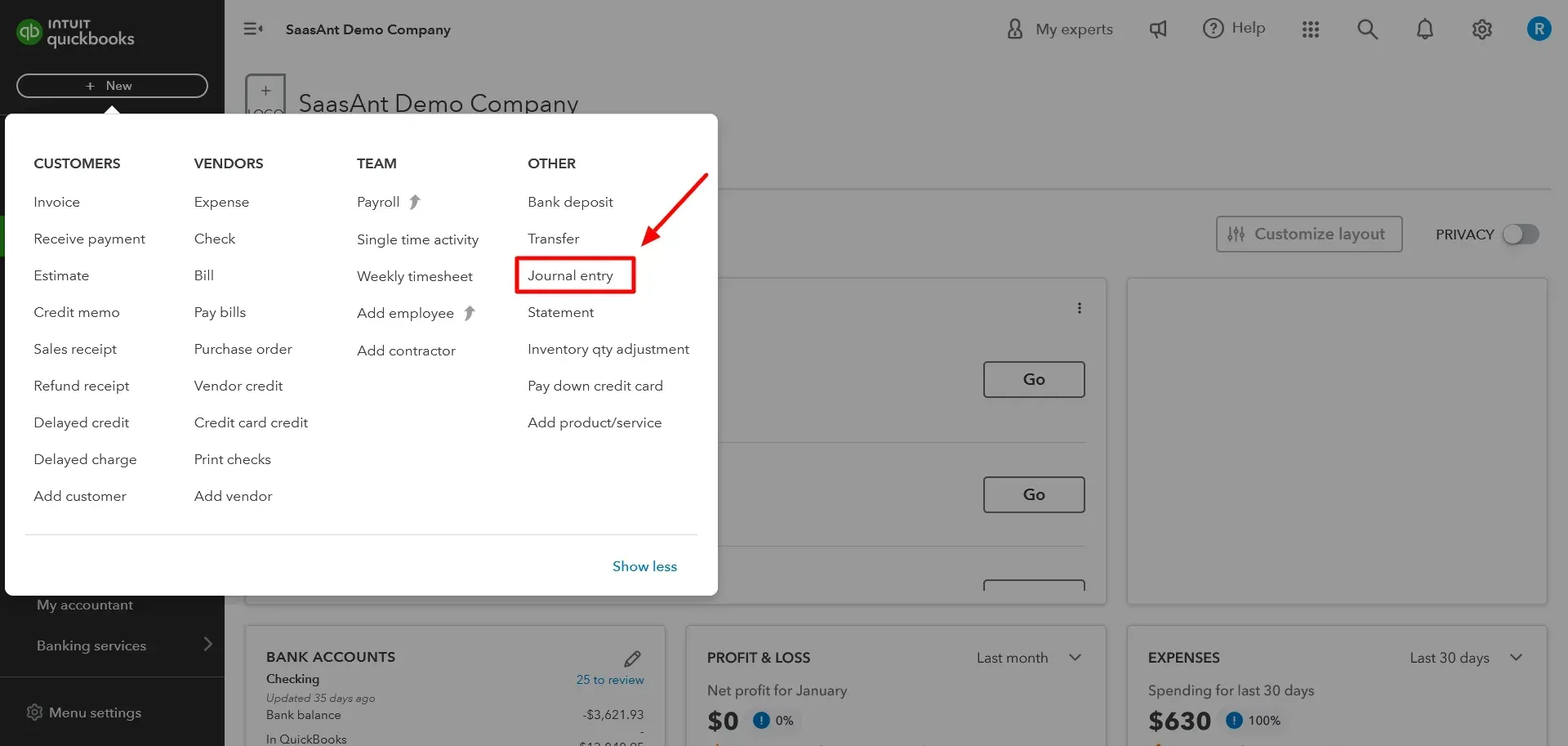

Click the ‘+ New’ button at the top left corner of the screen. It will open a menu with different options for creating transactions.

Click on ‘Journal entry’ under Other. It will open a form where you can enter the details of your journal entry.

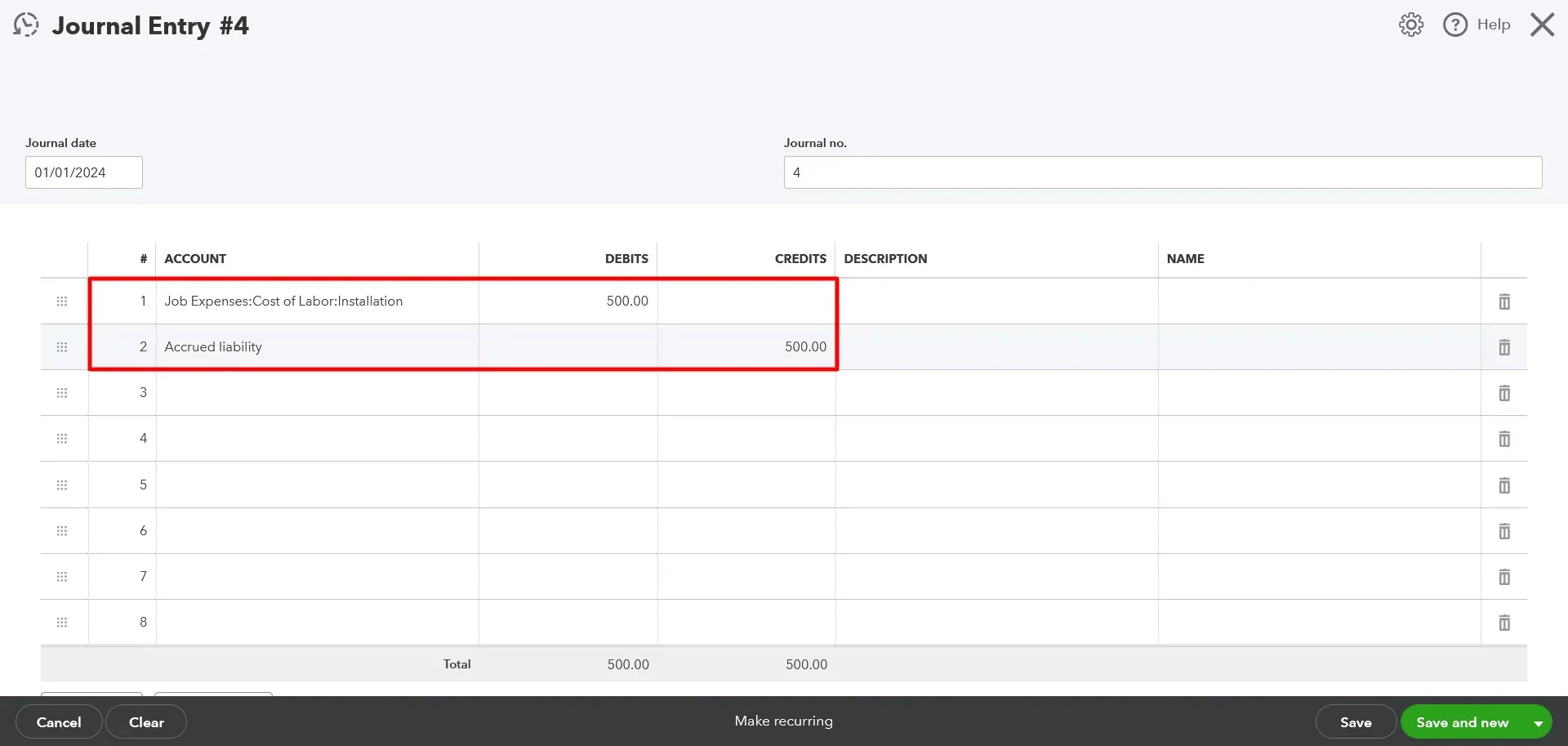

Enter the date and entry number for the journal entry. The date should be the last day of the month you record the accruals. The entry number should be sequential and unique for each journal entry.

Select the expense account for the accrual in the Account column on the first line. For example, select ‘Utilities Expense’ if you have an accrued utility bill.

Enter the accrual amount in the Debit column on the same line. For example, if your utility bill is $100, enter 100.

Select the Accrued Liabilities account in the Account column on the second line. This liability account tracks the amounts you owe but hasn’t paid yet. If you don’t have one, you can create one by clicking ‘Add New’ and choosing Other Current Liabilities as the account type.

Enter the same accrual amount in the Credit column on the same line. For example, enter 100.

Optionally, you can enter a description or memo for the journal entry in the Description or Memo fields. It can help you identify and explain the purpose of the journal entry later.

Click on ‘Save and close.’

You have successfully added a month-end accrual in QuickBooks. You can repeat these steps for each accrual you need to record.

Example of a Month-End Accrual

Date | Account | Debit | Credit |

31/01/2025 | Utilities Expense | 100 | - |

31/01/2025 | Accrued Liabilities | - | 100 |

How to reverse month-end accruals in QuickBooks?

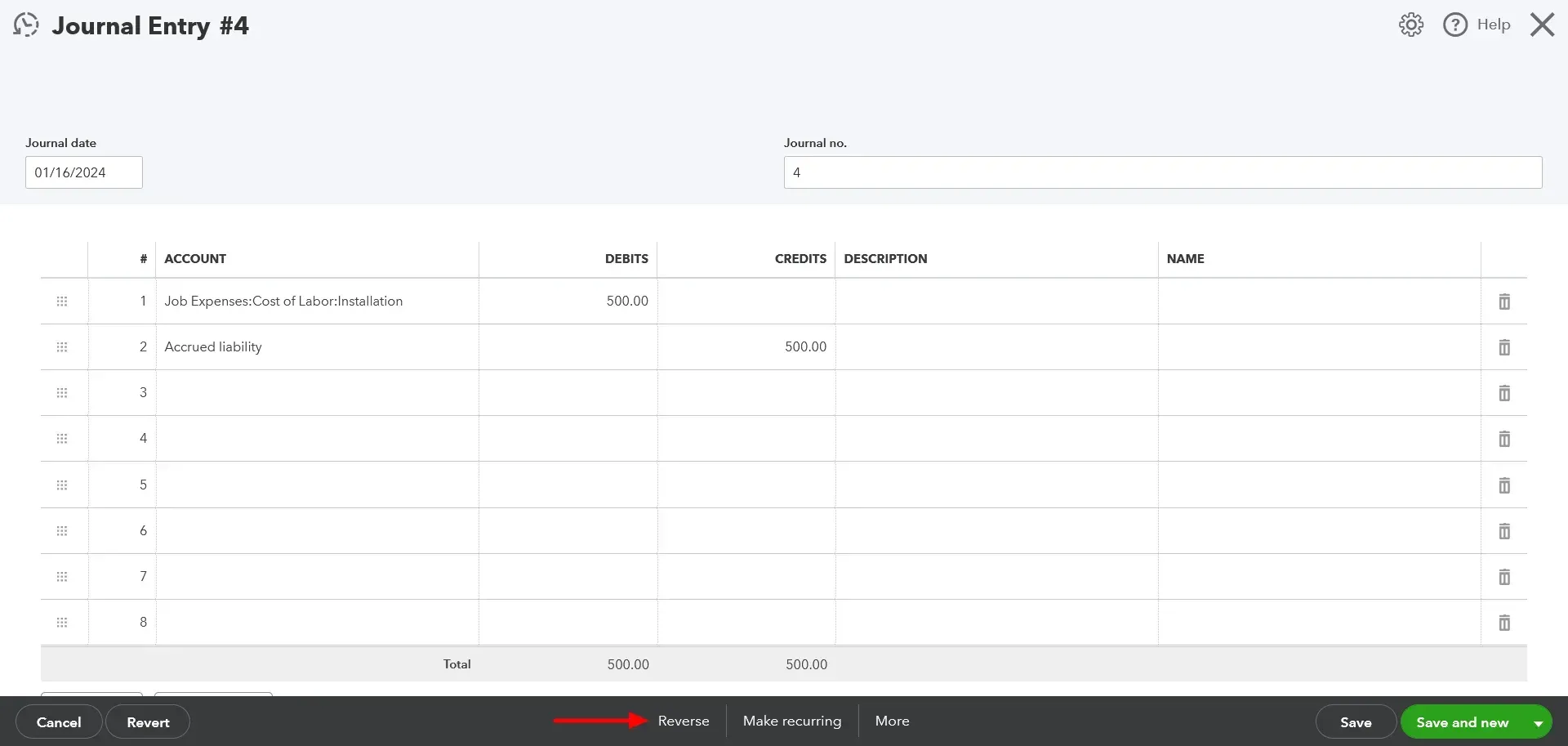

When you receive or pay the amount, the next action step is to reverse the accruals created earlier in QuickBooks. It means you create a new journal entry that cancels the original one. This way, you avoid double-counting the revenue or expense in both periods. Here are the detailed instructions for reversing accruals in QuickBooks:

Click the ‘+ New’ button at the top left corner of the screen.

Click on Journal entry under Other.

Find the journal entry you created for the accrual in the previous period. You can use the Journal no., Date, or Description fields to search for it.

Change the date to the first day of the current period. For example, if you created the accrual journal entry on January 31st, change the date to February 1st.

Click ‘Reverse’ at the bottom of the Journal Entry window. It will automatically swap the debits and credits of the original journal entry.

Click on ‘Save and close.’

You have successfully reversed an accrual in QuickBooks. You can repeat these steps for each accrual you need to reverse.

Common Types of Month-End Accruals

You’ll often encounter the following types of accruals during the month-end close process:

1. Accrued Expenses

These are costs incurred during the month that haven’t yet been billed or paid. Examples include:

Salaries and wages earned but unpaid

Rent payable at month-end

Utilities incurred but unpaid

Loan interest due

2. Accrued Revenues

These represent income earned but not yet invoiced or received. Examples include:

Services rendered but not yet billed

Commissions earned but pending payment

Interest income on deposits or investments

Recording these entries ensures both your income statement and balance sheet stay accurate.

Tips to Identify Month-End Accruals

Review Recurring Expenses: Identify monthly expenses you pay after the month-end, such as rent or utilities.

Check Service Contracts: Review vendor agreements to spot ongoing services that cross month boundaries.

Look at Payroll Schedules: If a pay period ends mid-month, accrue wages earned before the close date.

Consult Your Accountant: Complex accruals may require professional input to ensure compliance.

The Importance of Reversing Accruals

Reversing accruals in QuickBooks prevents duplicate expense or revenue recognition. This step is critical to maintaining clean and consistent financials.

Prevents Double Counting: Ensures the expense or income is only recorded once.

Improves Accuracy: Keeps income statements and balance sheets correct.

Supports Audit Readiness: Clean accrual management simplifies audits and reviews.

Automating Month-End Accruals with SaasAnt Transactions

Recording a few accruals manually is manageable, but for businesses dealing with dozens or hundreds of journal entries each month, the manual process can quickly become a bottleneck. SaasAnt Transactions automates this task by allowing you to import, edit, and manage bulk journal entries in QuickBooks in minutes.

Why Use SaasAnt Transactions for Accruals?

Bulk Journal Entry Import: Upload hundreds of accruals using Excel or CSV files instead of entering them one by one.

Error-Free Posting: Automatically validates data before posting to prevent mismatches or entry errors.

Reverse Entries in Bulk: Generate reversal entries for all accrued transactions in one go.

Scheduled Imports: Automate recurring accrual uploads every month-end.

Audit Trail: Each imported transaction includes full tracking and reporting.

How to Add Accruals Using SaasAnt Transactions

Prepare Your Journal Entries in Excel or CSV

Include columns for Date, Journal No., Debit Account, Credit Account, and Amount.

Ensure each entry has balanced debits and credits.

Open SaasAnt Transactions

Log in and connect your QuickBooks company file.

Choose Import Type

Select Journal Entry as the transaction type.

Upload File

Import your Excel or CSV file. The tool automatically maps your columns with QuickBooks fields.

Review and Validate

Check for missing data or mismatched accounts. SaasAnt highlights any errors before upload.

Click Import

Once validated, all entries are posted to QuickBooks instantly.

This process replaces hours of manual entry with just a few clicks, improving accuracy and saving time every month.

Streamlining Reversal Entries with SaasAnt Transactions

SaasAnt also supports bulk reversal of accruals. Instead of manually reversing each journal entry, you can automate the process:

Export your prior-month accrual entries.

In Excel, swap the debit and credit columns or use SaasAnt’s Reverse Entries option.

Import the updated file into QuickBooks.

Confirm the date is the first day of the new month.

In a few minutes, all reversal entries will be created and automatically synced to QuickBooks.

Benefits of Managing Accruals with SaasAnt Transactions

Feature | Manual Process | With SaasAnt Transactions |

Data Entry | One entry at a time | Bulk import using Excel |

Accuracy | Risk of human error | Automated validation |

Time Efficiency | Hours of manual work | Minutes per batch |

Reversals | Manual for each entry | Bulk reverse supported |

Reporting | Limited visibility | Full audit tracking |

Automation doesn’t just save time. It also ensures consistency and compliance across your financial processes.

Best Practices for Month-End Accrual Management

Maintain a Checklist: Keep a standardized list of recurring accruals like rent, utilities, interest, and payroll.

Reconcile Regularly: Match accrual entries with actual bills or income once posted.

Review Reports: Use QuickBooks’ Trial Balance and General Ledger reports to verify accrual balances.

Automate Workflows: Use SaasAnt Transactions to import and reverse entries in bulk every month.

Document Each Entry: Always include descriptions or memos for clarity during audits.

Final Thoughts

Month-end accruals are a crucial part of accurate accounting in QuickBooks. They ensure that your financial reports truly reflect what your business earned and owed within a period. However, doing this manually can be time-consuming and prone to mistakes, especially for businesses handling large transaction volumes.

SaasAnt Transactions simplifies the entire process by letting you import, automate, and reverse accrual journal entries in bulk. Whether you manage a single company or multiple clients, the integration with QuickBooks allows you to maintain clean books, reduce manual effort, and close your books faster each month.

Frequently Asked Questions

1. What are month-end accruals in QuickBooks?

Month-end accruals in QuickBooks are journal entries used to record expenses or revenues that have been incurred or earned but not yet paid or received. They ensure your financial statements reflect accurate income and expenses for the correct accounting period.

2. How do I record accruals in QuickBooks Online?

To record an accrual in QuickBooks Online, click + New → Journal Entry, set the date to the last day of the month, debit the appropriate expense or revenue account, and credit the accrued liability or accrued income account. Add a memo for clarity, then save and close.

3. Can I automate month-end accruals in QuickBooks?

Yes. QuickBooks allows you to create recurring journal entries for regular accruals. For larger volumes, you can use SaasAnt Transactions to import multiple accrual entries in bulk directly from Excel or CSV files, saving time and reducing manual work.

4. How do I reverse an accrual in QuickBooks?

To reverse an accrual, locate the original journal entry, change the date to the first day of the next month, and click Reverse. QuickBooks will automatically switch the debit and credit amounts, ensuring the accrual is cleared in the next period.

5. How does SaasAnt Transactions help with month-end accruals?

SaasAnt Transactions integrates with QuickBooks to automate data import and reversal processes. You can bulk-upload journal entries, validate data for accuracy, and create reversal entries for multiple accruals at once. This helps accountants close their books faster and maintain error-free financial records.